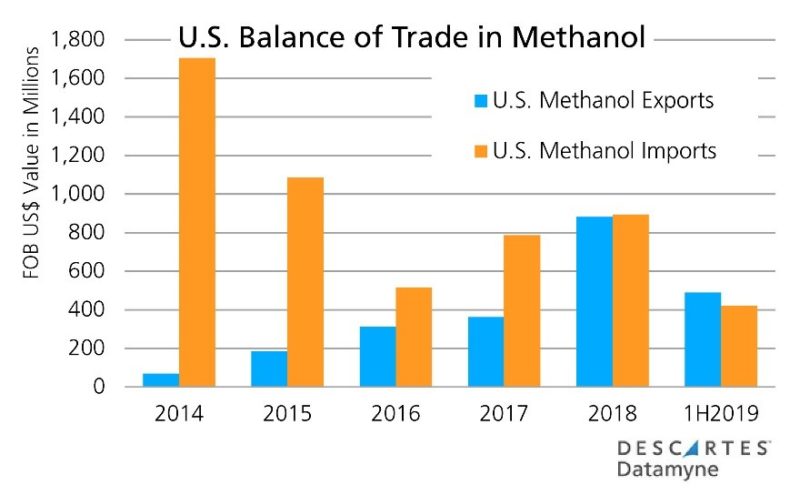

In the first half of this year, Descartes Datamyne trade data shows, the U.S. swung from net importer to exporter of methanol [HS290511], a basic petrochemical derived from natural gas.

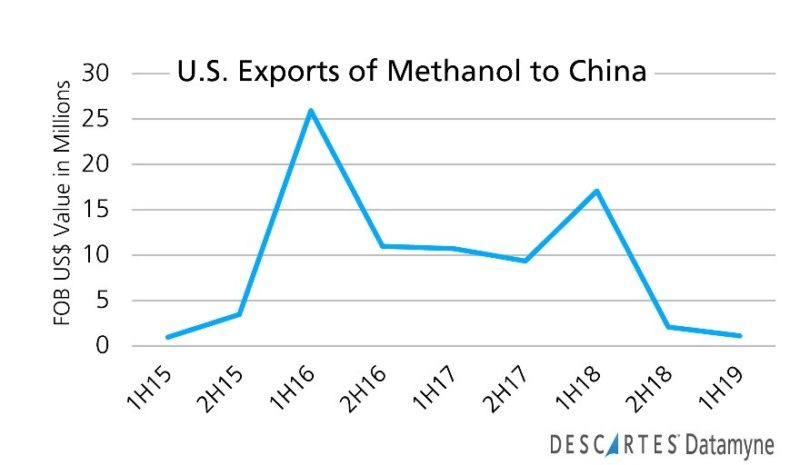

The trade surplus might have been more substantial had shipments to China not dropped precipitously, a casualty of the U.S.-China trade war:

As of year-end 2018, the shale revolution helped the U.S. return to a net exporter of crude and refined oils after 75 years as a net importer of these fuels. Now, thanks again to shale, the U.S. is positioned to be a net exporter of petrochemicals.

Petrochemicals to drive growth in demand for oil

As with petroleum, petrochemicals hold the promise of narrowing the U.S. trade gap – perhaps further into the future. That’s because, as the International Energy Agency (IEA) notes, as the world shifts to alternative fuels over the next decade, global demand for oil will be driven by the need for petrochemical feedstocks.

In its 2018 report, The Future of Petrochemicals, the IEA projects growth in total oil demand of nearly 10 million barrels per day (mb/d) for 2030, with the chemical sector accounting for more than a third of the increase. Based on current trajectories, the sector’s share of new demand will climb to nearly 50% in 2050.

On a parallel track, demand for primary petrochemicals is set to grow 30% by 2030 and 60% by 2050. According to the IEA, methanol is expected to lead global growth in primary chemicals, with output surging 50% by 2030 and nearly doubling by 2050. While North America accounts for a small share, it is the region with the fastest growth in production: methanol output is projected to triple by 2050.

Demand for methanol is rising on two applications: Its use as a fuel additive accounts for 35-40% of demand. The balance goes to deriving high-value chemicals (HVCs).

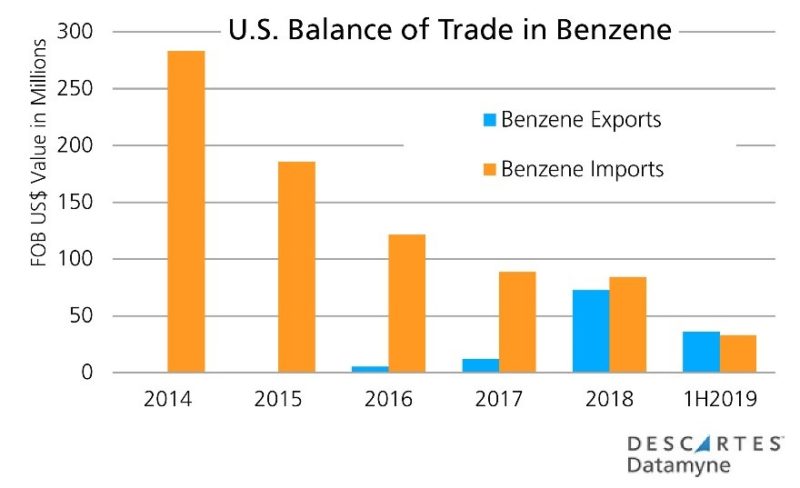

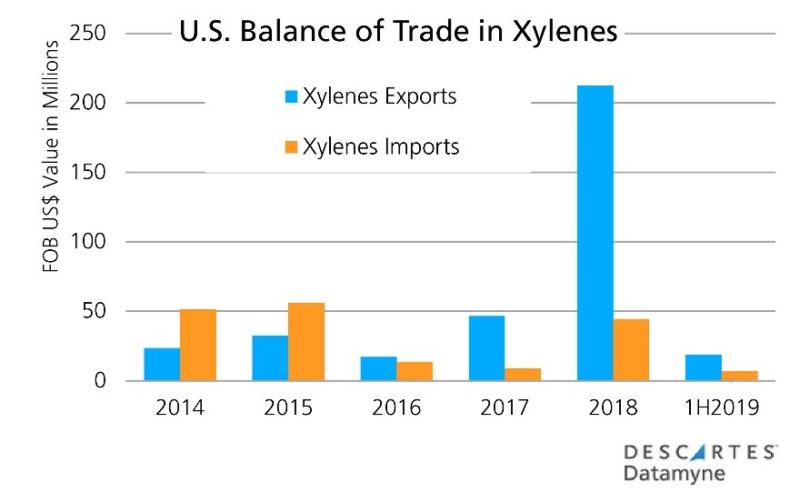

The American Chemistry Council (ACC) estimates that seven petrochemicals are the basis for more than 90% organic chemical production. Methanol (an alcohol) is one of them. The others are benzene, toluene and xylene (collectively, aromatics); and ethylene, propylene and butadiene (olefins). From these are derived the organic intermediates that are used still further downstream to produce plastic resins, synthetic rubber, man-made fibers, surfactants, dyes and pigment, inks, and more.

At the end of the stream (and up the value chain) are tens of thousands of products for consumer markets and industrial processes.

The shale advantage in producing petrochemicals

The U.S. swing to net exporter of methanol is in line with ACC projections of a growing trade surplus in chemicals. The trade association cites abundant shale gas resources bestowing on U.S. manufacturers a global market advantage in comparatively lower production costs.

In a bid to leverage that competitive edge, energy and chemicals companies have been building and expanding petrochemical production facilities. The ACC estimates American shale gas has attracted $204 billion in U.S. chemicals industry investment.

A big chunk of that investment – more than $140 billion – is earmarked for the Gulf Coast reports the Houston Chronicle. At the foot of the Texas shale fields, the Gulf is the center of the shale-fueled growth in U.S. petrochemical production.

As more new production comes online, more petrochemicals are available for domestic users, thus decreasing imports, as well as global markets, boosting U.S. exports.The ACC projects exports of specific chemicals directly linked to shale gas will reach $123 billion by 2030, more than double the total in 2014

In additional to the methanol milestone, our first-quarter 2019 trade data also indicates shifts to a U.S. trade surplus in primary petrochemicals benzene [HS270710] and xylenes [HS270730], as these next graphs illustrate:

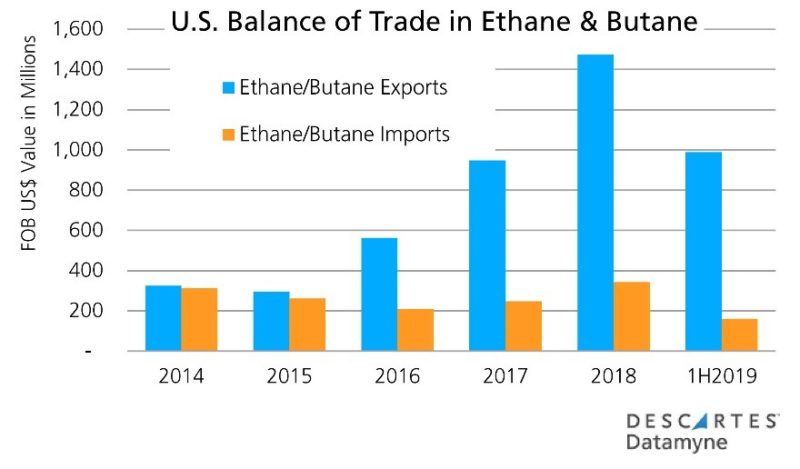

Moving downstream to ethane & butane [HS290110], what had been a very modest surplus in trade of 4% in 2014 has grown to 330% as of last year, as shown in the next graph:

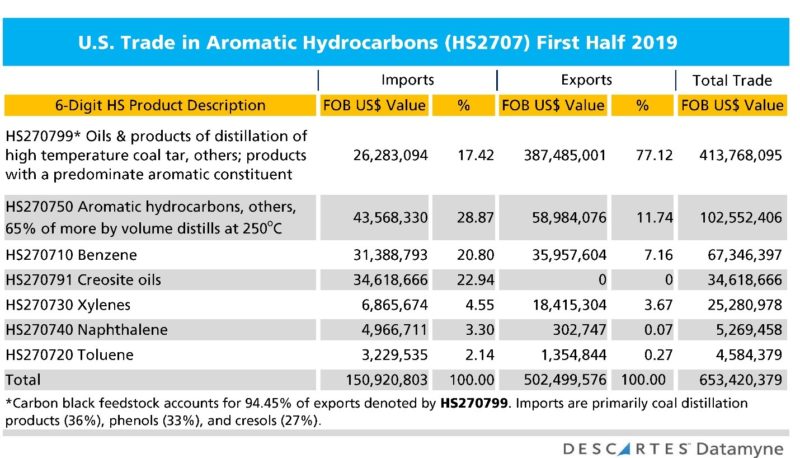

The next table summarizes U.S. first-half trade in the product category of aromatic hydrocarbons [HS2707], a net export. These products, ranked by total value of trade, provide context for the shift to net export status by benzene and xylenes, cited above.

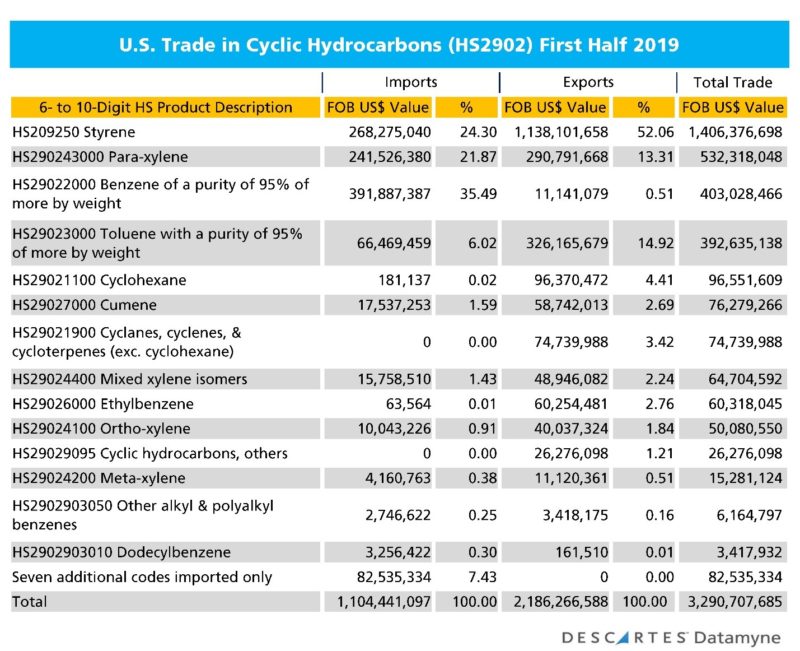

The balance of trade also tips decidedly to exports in the product category of cyclic hydrocarbons [HS2902]. Here is the first-half trade data for these petrochemical or organic intermediates:

The ACC mid-2019 outlook is generally upbeat on prospects for continued production growth (which appeared to falter at the start of the year). Domestic end-use markets and the price advantages of shale-based energy and inputs remain the keys to sustained growth.

To be sure, tariffs and trade tensions have constrained exports, which have not performed as well as anticipated a year ago. Even so, at mid-year ACC projected the U.S. chemical industry trade surplus will continue to grow in 2019 on a 5.9% increase in exports against a 2.4% rise in imports.

Related blogs: