The first hiccups in trade with Greece following that country’s rejection of creditors’ demands for more austerity are being felt. The Wall Street Journal reports that Greece’s capital controls on the outward flow of euros are choking commerce as exporters to Greece demand payment in cash and Greek importers are barred from sending cash out of the country. Exceptions are being promised for food and medicine – but winning an exemption will involve redtape.

The immediate impact on US trade is likely to be limited. Our global trade data on Greece shows the country ranking 79th among US trading partners in first quarter 2015, accounting for US$496,154,087 – a scant .05% of US trade in that period.

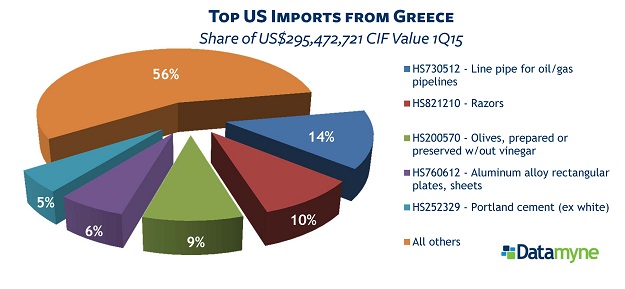

Still, US companies that import from or export to Greece will certainly feel the pinch. Here are the top trade commodities in US-Greece trade by value:

It’s worth noting that in trade in these commodities Greece is an important player.

For example, Greece is the US second-ranked source for pipes for oil and gas pipelines (behind NAFTA partner Canada), supplying 28% of the total imported in 1Q15. Greece is also the No. 2 country of origin for imported razors (NAFTA partner Mexico is No. 1) accounting for 21% of incoming shipments in the first quarter. And it ranked second (behind Spain) as COO for US olive imports, with 29% share in 1Q15.

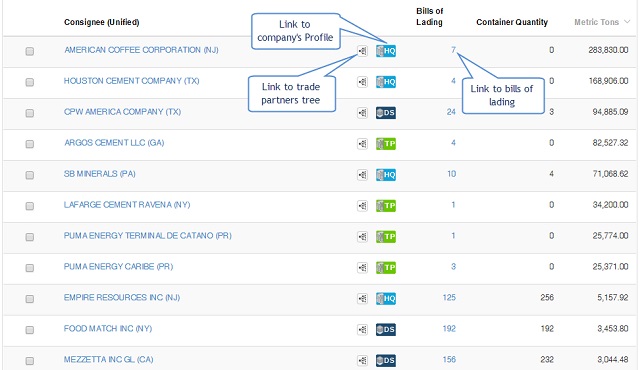

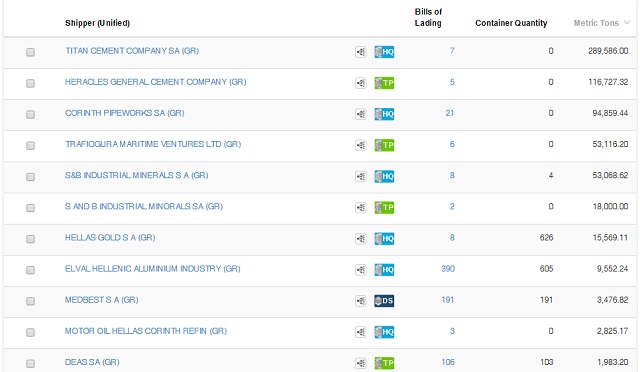

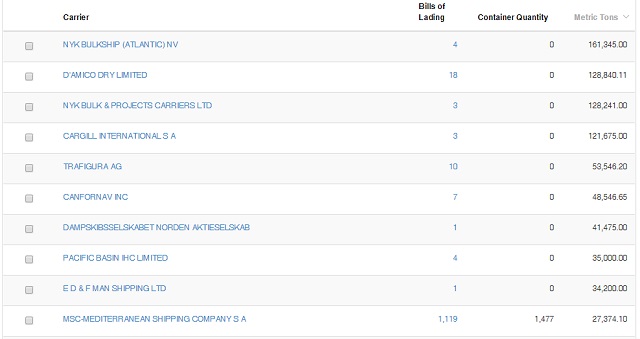

Our US import bill of lading data provides more detail, including who is doing business with Greece now. Here are the top 10 consignees, shippers and carriers of US maritime imports from Greece, ranked by volume, as captured by our first-quarter BoL data:

Longer term impacts on trade – especially if no new bailout plan is reached and Greece exits the EU – will be broader and deeper, as they affect the Eurozone economy, global currency rates and international capital markets.

If you would like to talk to one of our trade data specialists on how you can track the impact of this (or any other crisis) on cross-border commerce, just ask us.

Related: