As the UK nears its latest deadline for departing the EU, what will happen next remains unclear. Descartes Datamyne international data – including our new UK database – keeps Brexit’s ongoing effects on global trade in sharp focus.

“Entrenched uncertainty” – that’s how Mark Carney, governor of the Bank of England, describes the steady-state of UK economic affairs since the June 6, 2016, referendum approving the United Kingdom’s withdrawal from the European Union.

In the face of uncertainty about Brexit and, especially, its effects on trading relationships, UK business investment, which had been growing apace with the average set by the G7, slowed to 1% compared with 12% for the rest of the group, the Bank of England reported in August.

Ahead of this year’s March 29 deadline for Brexit, stockpiling drove up UK trade with the EU in the first quarter. Failure to reach an agreement with the EU on terms of the UK’s departure led to a postponement of the day of reckoning, and an abrupt drop in trade in the second quarter.

As UK prime minister Boris Johnson’s October 31 deadline for leaving the EU – with or without a deal – approaches, hopes for an agreement seem to rise and fall with each daily news cycle.

So, for instance, the pound sterling rose sharply Thursday, October 10 on news that Johnson and Ireland’s prime minister Leo Varadkar could see a pathway to agreeing on one of the biggest obstacles to a deal: how to manage the customs frontier Brexit would create between Ireland and Northern Ireland. But, after a round of talks over the weekend, EU officials made it clear that there was no breakthrough in sight from where they sat. By Thursday, October 17, hope (and the pound) soared again as the UK and EU announced a tentative deal to put before Parliament.

What happens next remains uncertain. A deal may yet be reached. Or another extension may be sought and granted. In the worst-case scenario of a no-deal Brexit on October 31, trade flows between the UK and the EU could be cut 45% on day one, according the UK’s National Audit Office.

The antidote to uncertainty is preparation based on the best information available on potential exposure to and the ongoing effects of unfolding events. Descartes Datamyne has three data products – two new and all with newly enhanced ranking features – that can provide strategic insight into UK, EU, and global trade pre- and post-Brexit.

Preparing for Brexit: GlobalStats on World Trade

The new Descartes Datamyne GlobalStats database, covering the import-export trade of the more than 200 countries and territories in the United Nations Commodity Trade Statistics Database (UN Comtrade), offers a global view of trade patterns and relationships.

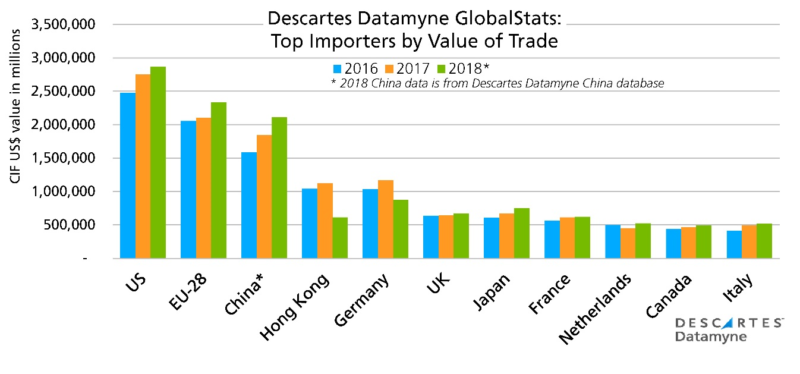

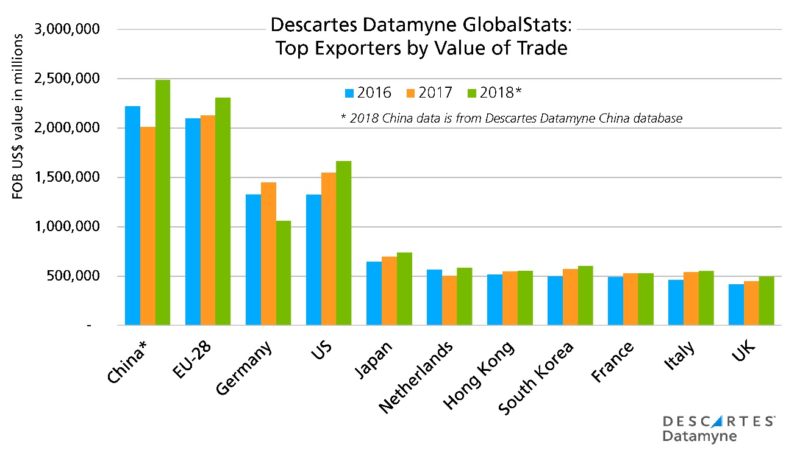

Here, for example, are the world’s top importers and exporters ranked by value of trade beginning with 2016 through 2018, three volatile years for international commerce:

The UK ranks sixth among the world’s importers and 11th among exporters (or fifth and 10th if the EU-28 is removed from the ranking).

The GlobalStats data shows an increase in UK trade in both directions in 2018. UK imports rose 4.6% year-over-year in 2018 compared with 0.8% growth in 2017. This growth would be consistent with stockpiling ahead of the March Brexit deadline. UK exports were up 10.9% in 2018 compared with 7.4% in 2017, robust growth the government credited to its Export Strategy and growing demand from non-EU countries, led by the U.S., Australia, and Switzerland.

Note that the data on Chinese trade in 2018 is from our China database. The schedule of reporting data to Comtrade varies by country. GlobalStats includes a data availability reference that tracks the latest data from each reporter. In many cases, country data not yet available from Comtrade can be obtained from Descartes Datamyne’s international databases.

Preparing for Brexit: EU-28 Data

Descartes Datamyne’s EU data has long been a feature of our international databases. Our new rankings feature provides a new, more intuitive interface that makes it easier to access and analyze data about the trade activities of the customs union and its members.

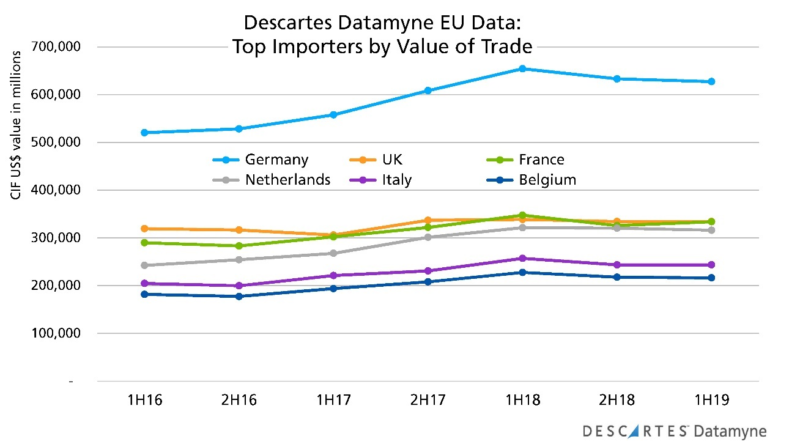

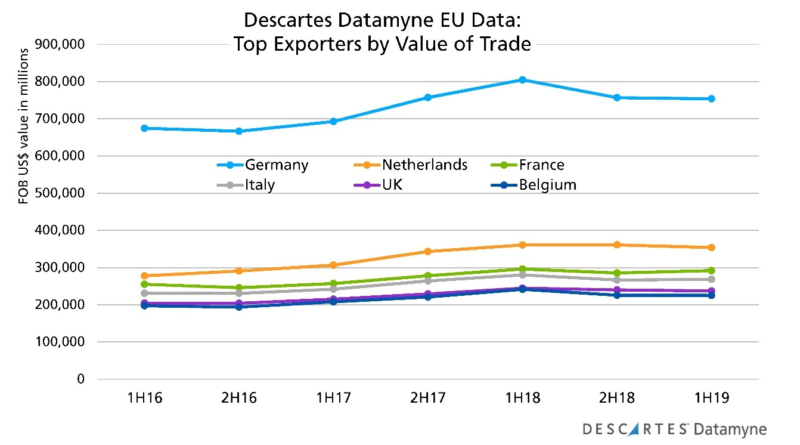

The next graphs illustrate Germany’s leadership among the EU’s top importing and exporting members:

The UK ranks a distant second in the ranking of EU importers. A slight decline (-0.002%) in the first half of 2019 indicates that the sharp rise in imports in the first quarter, mentioned above, was mirrored by an equally sharp fallback in the second quarter. Over the same period, France posted modest growth (0.02%), pulling it closer, but just shy ($510M) of overtaking the UK in second place.

Otherwise, for the EU’s top importers – indeed, for the EU as a whole – growth was virtually flat (Italy) or edged down in 1H19 compared with 2H18, and with the same period a year ago.

The UK ranks fifth among the EU’s exporters. In this trade, too, France and Italy bucked the trend in 2H18 to 1H19 and managed to grow their exports. Exporters further down the ranking – including Spain, Poland, the Czech Republic, and Austria – also gained enough to keep EU export growth in positive territory (0.56%). But the EU’s 1H19 gain followed a 4.2% loss in 2H18, leaving 1H19 exports down 3.6% year-over-year.

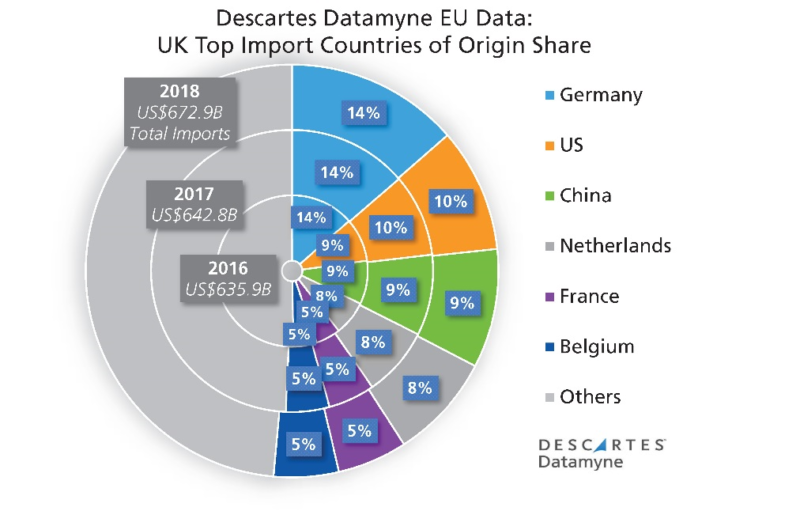

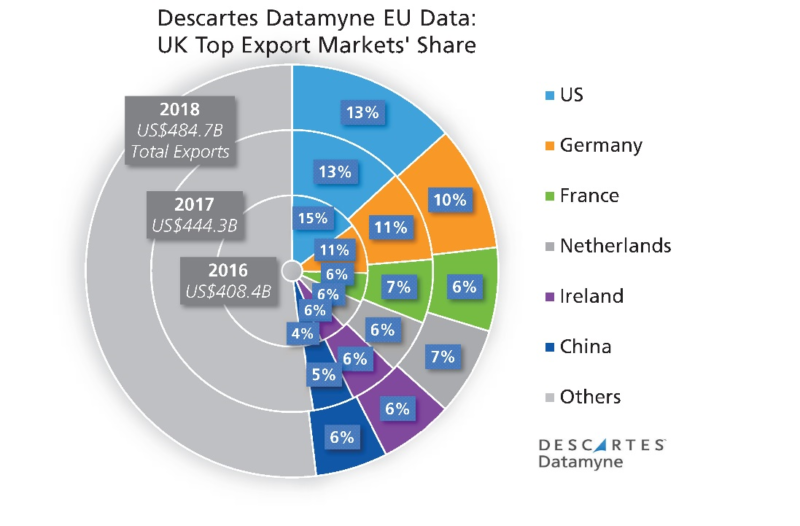

Here, based on our EU data, are the UK’s top trading partners by share from 2016 through 2018:

The top six account for roughly half (48% to 49%) of UK trade in both directions. In each case, four of the top six are EU member nations, with the balance claimed by the U.S. and China. Note that there’s been little change in the relative position of the UK’s top sources for imports.

Similarly, the UK’s top export markets don’t appear to have shifted much over the last three years, although there has been a two-percentage-point loss of share by the U.S. along with the two-point gain by China during this period.

Preparing for Brexit: UK Data

Descartes Datamyne has been preparing for Brexit with a new database dedicated to UK trade that starts with January 2018 and is updated monthly (with a two-month lag in data release).

Sourced from UK customs authorities, our UK data offers our new rankings feature and a query function that enables users to filter the data by country of origin or destination, port of arrival or departure, clearance location, and transport method, as well as a keyword search of entire fields on the shipment record. The query function is fully equipped with trend by, total by, grid reports, and visualization tools.

A special feature of the UK data is a directory of the names and addresses of UK companies that are parties to trade with countries outside the EU, as well as the commodities codes they are receiving or shipping.

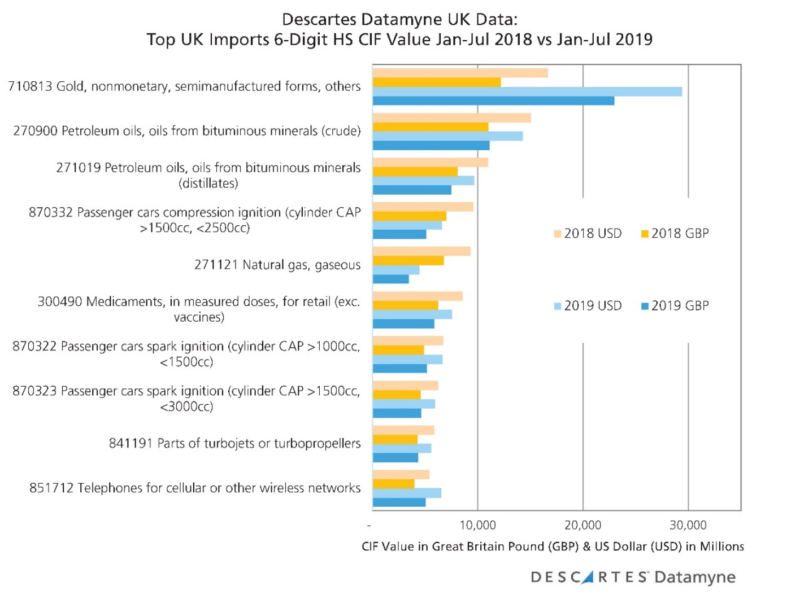

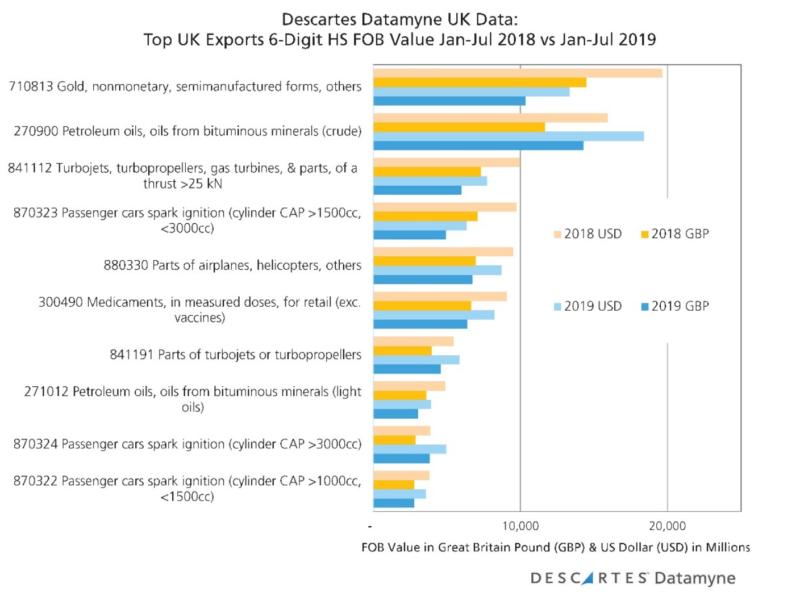

We used this data to break out imports and exports at the 6-digit Harmonized System level, comparing activities through the first seven months of this year with those of January-July 2018. This graph tracks trade in the top 10 imports:

Note that the UK data provides trade value in the pound sterling and the US dollar. The most striking finding is the surge in UK imports of gold. As the FT reported in September, the imports are driven in large part by investor demand for gold-backed exchange traded funds, a not unexpected result of entrenched uncertainty.

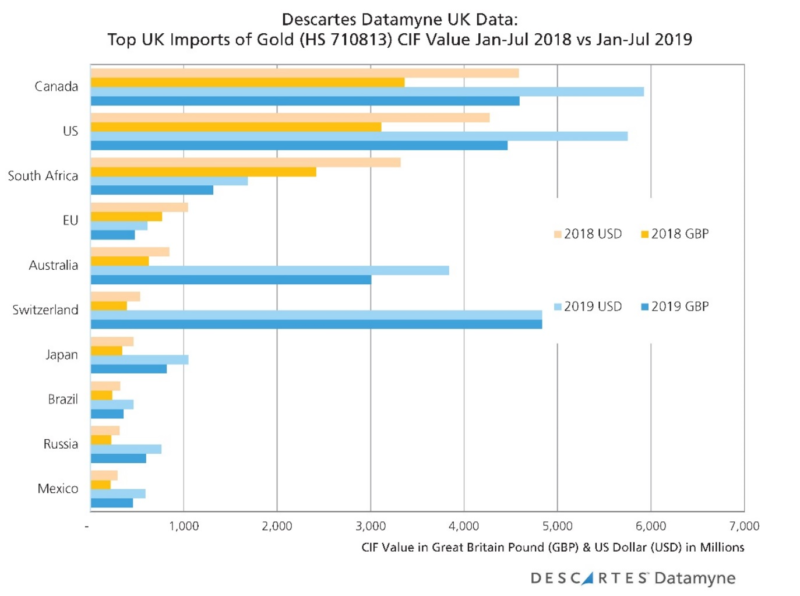

A closer look at our UK data reveals Switzerland is the source for much of the gold, although the U.S. and commonwealth partners Canada and Australia are also meeting gold-bug demand:

Here is a summary of the UK data on the current top 10 exports:

The preponderance of cars and, further down the rankings, car parts in both import and export trade underscore the vulnerability of carmakers to a “hard Brexit” – that is, a no-deal Brexit. Automobile manufacturing is a pan-European industry and without an agreement, UK carmakers are sure to be handicapped.

The UK has a temporary tariff regime ready for a no-deal departure. But critics argue that, in exempting the majority of imports from tariffs, the plan prioritizes protecting UK consumers over UK exporters. So, for instance, carmakers trading in auto parts would be hit with up to a 10% duty on the way out, while inbound parts would be duty-free. Some EU carmakers have announced they are shelving plans to build or expand UK-based facilities pending Brexit.

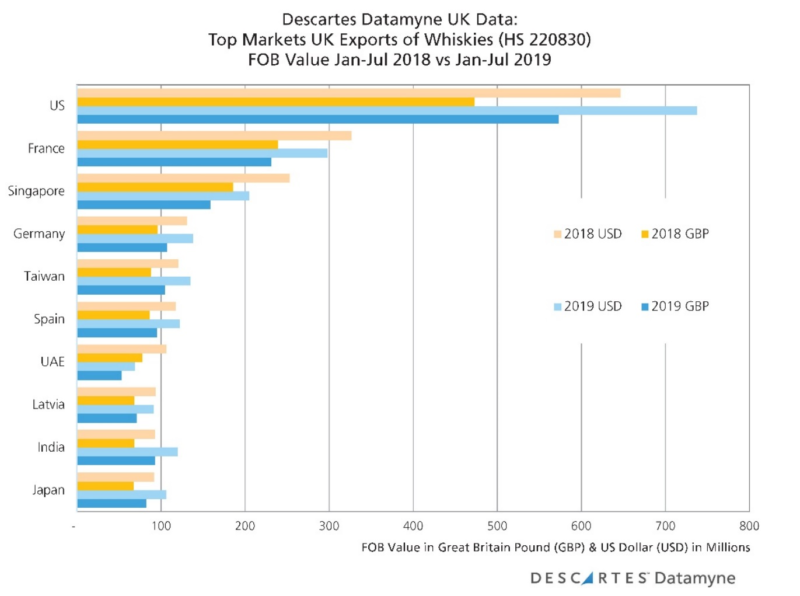

Our closer look at UK export data focuses on whiskies, a trade commodity that routinely ranks just below the top 10. Here we see a spurt in demand (stockpiling?) for this signature product of the UK from the U.S., Taiwan, India, and Japan:

Preparing for Brexit: Non-tariff Barriers

It would be a mistake to think that concerns about a hard Brexit are just about the money. The EU customs union sets the rules for “everything from medicines to electricity connections to financial services,” as the FT reports.

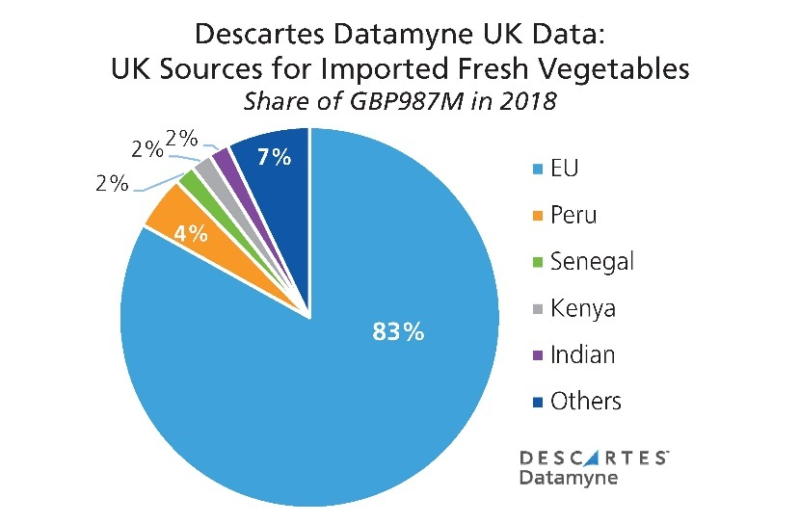

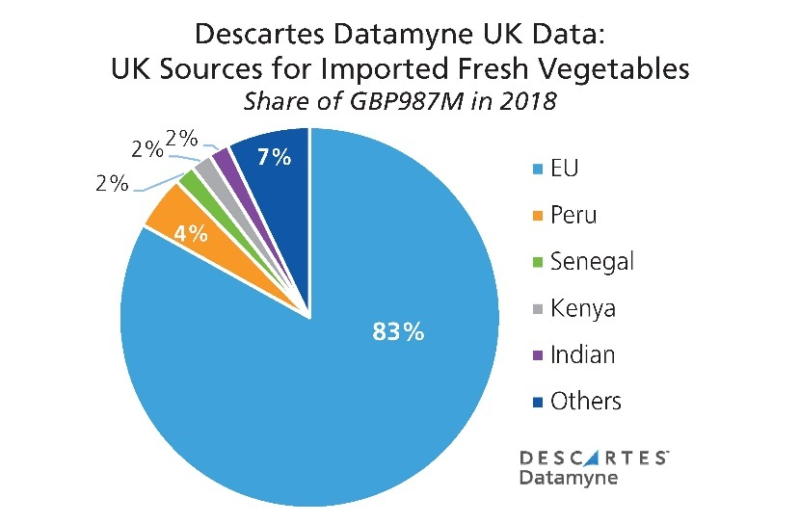

UK consumers rely on imports for fresh fruits and vegetables after their early-November harvest, mostly from the EU (see the chart below). They are genuinely concerned about getting food from countries (such as the U.S.) that don’t comply with EU sanitary and phytosanitary standards. They don’t want to open their refrigerator doors to frankenfoods, chlorine-washed chicken, and hormone-fed beef.

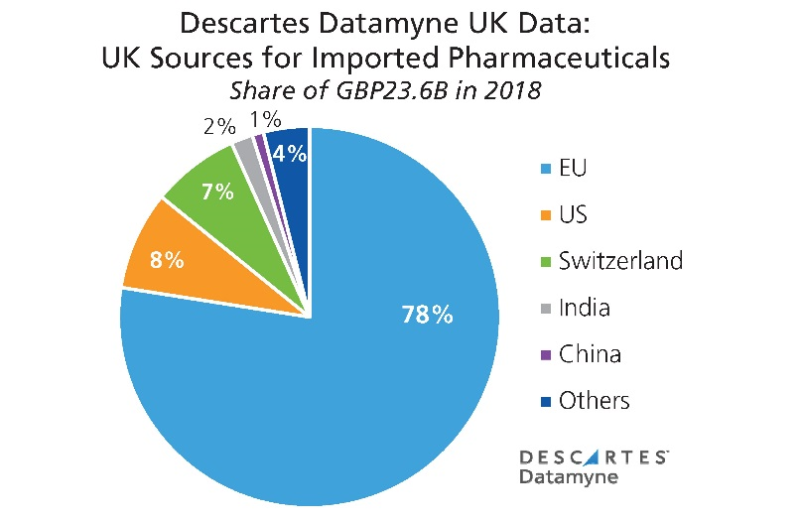

Similarly, the UK relies on the EU for its pharmaceuticals. Latest reports are that express freight services are being engaged to ensure supplies of urgent medicines and medical products after the October 31 deadline. Meanwhile, the UK’s pharma companies are pressing the government to align with the EU regulatory regime post-Brexit.

Finally, there is the over-arching concern about the UK’s place in the global economy. Renegotiating its trade relationships with the rest of the world will be daunting. As a member of the EU, the UK is party to some 40 free-trade agreements with more than 70 countries.

Trading partners such as the U.S. say they are ready to enter new trade pacts with the UK. Even so, the agreements must wait on a resolution of Brexit. Canada, for one, has been holding back on negotiations with its fellow Commonwealth member because it expects a no-deal Brexit will open the way for low or no tariffs on its exports.

How Descartes Can Help:

Descartes can help you with every step in the move toward Brexit and beyond; providing news, expert advice, information, and solutions to your Brexit challenges. Keep up-to-date with our Brexit Resource Center.

Descartes EU CustomsTM can help businesses seamlessly keep pace with the quickly approaching regulatory changes Brexit promises. Our leading EU customs solution enables a more efficient and cost-saving customs clearance to the various countries across Europe while ensuring instant and ongoing compliance with the multiple different procedures across EU member states.

Click here to ask us more about the Descartes EU Customs solution.

More resources:

If you would like to see more trade data from our UK, EU, or GlobalStats databases, please contact us for a free online demonstration at your convenience.