President Donald Trump and China’s Vice Premier Liu He have signed an initial agreement that commits China to policy changes on intellectual property (IP), technology transfer, financial services, and currency management. China also promises substantial purchases of goods and services from the U.S.

Announced in mid-December, the U.S.-China Phase One agreement signaled a de-escalation in tensions that have rattled relations between the world’s top trade duo for nearly two years. The fact sheet issued by the U.S. administration on December 13 offered an overview of the agreement’s scope, but few specifics.

The full text of the 96-page agreement, released after the January 15 signing ceremony in Washington, consists largely of a program of reforms to Chinese trade policy and practice.

Briefly, the formal agreement’s Technology Transfer chapter spells out China’s binding obligations to address the technology transfer practices cited in the U.S. Trade Representative’s 2017 Section 301 investigation, which led to in several rounds of tariffs imposed on Chinese imports starting in August of 2018. The latest round of tariffs, which would have extended duties to virtually all Chinese imports effective December 15, was shelved when the Phase One agreement was announced on December 12.

The agreement’s IP chapter addresses longstanding concerns regarding China’s protections for trade secrets and trademarks, practices in identifying geographic origins of products, and enforcement against pirated and counterfeit goods. The Agriculture chapter lowers multiple non-tariff barriers to U.S. ag, seafood and biotech exports. The Financial Services chapter aims to open the Chinese market to U.S. providers of banking, insurance, securities, and credit rating services.

A chapter on Microeconomic Policies and Exchange Rate Matters addresses currency practices that tilt the competitive field against U.S. exporters. On the eve of signing, the Trump administration dropped its formal designation of China as a currency manipulator, a concession sought by Beijing.

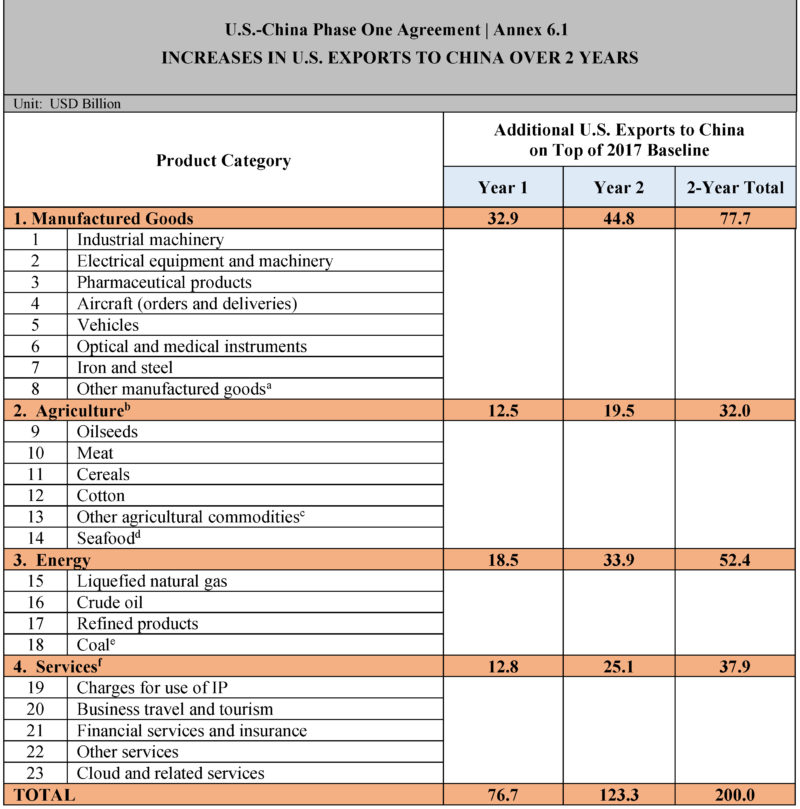

The agreement includes commitments from China to boost imports from the U.S. over the next two years to a total that exceeds the value of 2017’s imports by at least $200 billion. These commitments cover a variety of commodities, manufactured products and services.

Finally, the Dispute Resolution chapter lays out arrangements to implement the terms of this initial agreement, resolve trade disputes between the U.S. and China, and provide for regular bilateral consultations.

U.S.-China Phase One Agreement: The List, Please

The U.S.-China Phase One agreement’s market-opening and economic liberalization reforms have been welcomed as a step towards a reset of the two countries’ relationship after nearly two years of trade war.

But for the U.S. manufacturers, retailers, and affiliated trade partners that rely on imports from China, the more immediate concern was the extent to which tariffs as high as 25% ad valorem might be reduced on what products and when. It now seems that any roll-back of Section 301 tariffs will be part of a Phase Two agreement not likely to be reached before November’s elections.

The U.S.-China trade war has been waged with lists of 8- and 10-digit Harmonized System (HS) tariff codes denoting goods to be subjected to steep import duties. To recap:

- U.S. List 1 covered 818 individual codes covering products with a total trade value of $34 billion to be subject to duties effective July 2018. These so-called Section 301 tariffs (a reference to the legislation authorizing tariffs aimed protecting national security) were first set at 10% and subsequently raised to 25%.

- U.S. List 2 added 279 HS codes, valued at $16 billion in trade, for extra import duties effective August 2018, initially 10%, subsequently 25%.

- U.S. List 3 added 5,733 HS codes for goods accounting for $200 billion in imports, subject to 10% tariffs September 2018. These too were bumped up to 25%

- U.S. List 4 added 3,805 HS codes, worth $300 billion, further split into two lists: List 4A, accounting for $120 billion in trade, became subject to 15% tariffs effective September 1, 2019. List 4B, representing another $160 billion in goods, was due to be hit with higher tariffs December 15. This last tranche was spared the tariff hike when the phase one agreement was announced in mid-December; the administration promised a second announcement, reducing the tariffs on List 4A products from 15% to 7.5%, to be issued soon.

China retaliated with its own tariffs, imposing a 25% duty on 545 products worth $34 billion in trade on July 6, 2018, and an additional 333 products valued at $16 billion on August 23, 2018. As China’s imports from the U.S. are far fewer than its exports to the U.S., its lists of HS codes subject to retaliatory tariffs are far shorter. Further retaliation took the form of canceling orders for U.S. imports, especially agricultural commodities such as soybeans.

The Trump administration’s mid-December announcement of the Phase One agreement clearly stated that the U.S. would be maintaining 25% tariffs on approximately $250 billion of Chinese imports (that is, Lists 1, 2 and 3), along with 7.5% tariffs on approximately $120 billion in goods on List 4A. At the same time, the announcement promised the U.S. would “modify its Section 301 tariff actions in a significant way.”

China’s own announcement and public statements (see, for example, here and here) indicated an expectation that a phased roll-back of levies would be part of the deal. But in the end, the U.S. kept its existing tariffs in place as a guarantee that China keep its commitments under the pact. Neither tariffs nor Section 301 get a mention in the Phase One agreement.

For U.S. exporters, on the other hand, there is a list of HS codes identifying the products China will be purchasing more of in the next two years. Here are the particulars of the commitment:

Following this table in the agreement is a list of 547 HS codes for goods that may be purchased in fulfillment of the China’s commitment to boost imports from the U.S.

U.S.-China Phase One Agreement: Still Decoupling

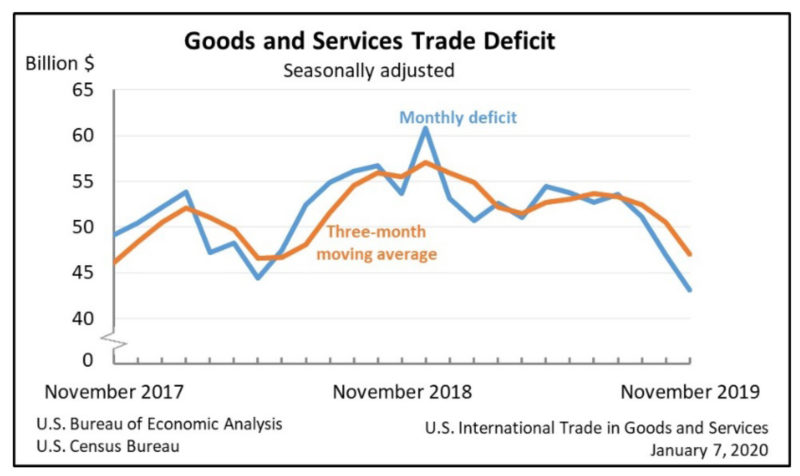

Earlier this month, the Census Bureau and the U.S. Bureau of Economic Analysis reported that the goods and services deficit had fallen to a three-year low of $43.1 billion in November, down $3.9 billion from October’s $46.9 billion. Year-to-date, the goods and services deficit decreased $3.9 billion, or 0.7 percent, from the same period in 2018.

The narrowing trade gap is largely the result of depressed imports from China.

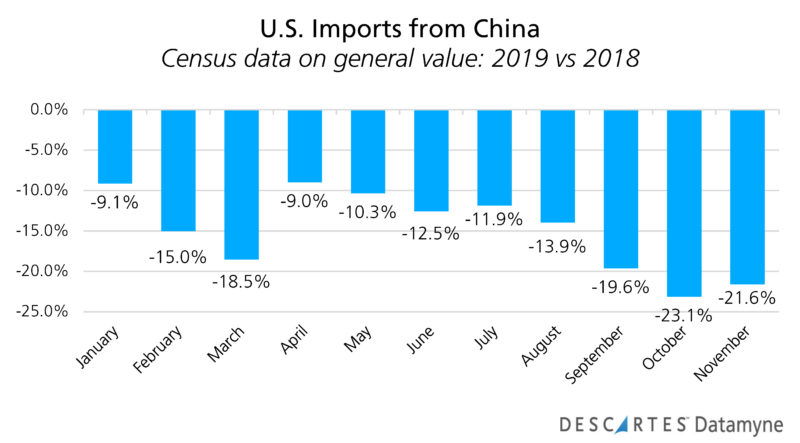

Descartes Datamyne data charts the deep impact of U.S. tariffs. Here is the Census data through November (the latest month available):

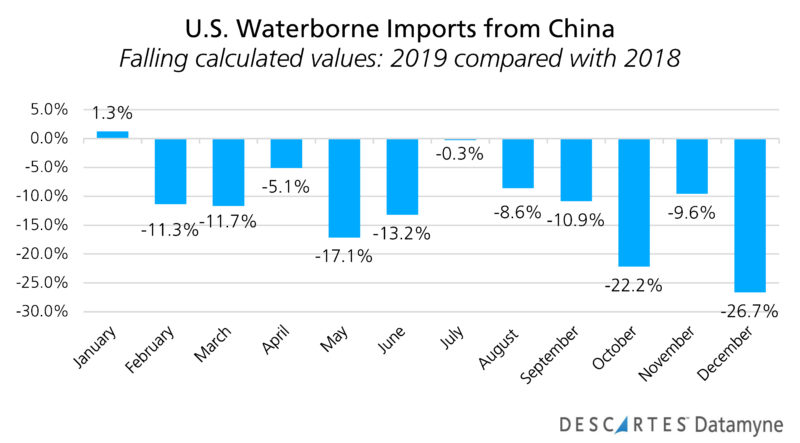

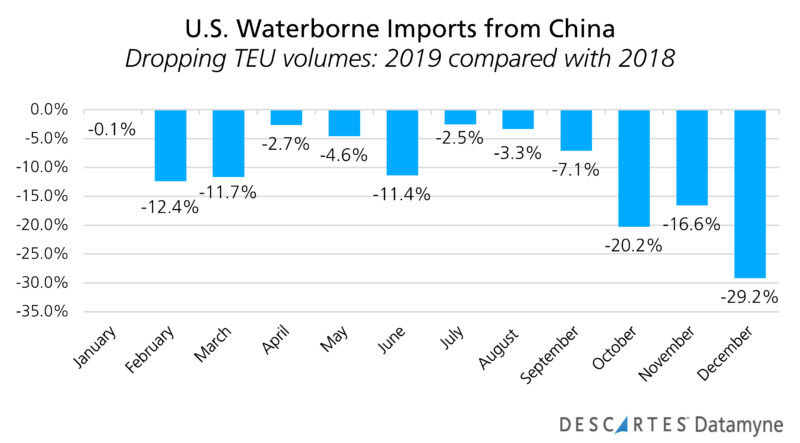

Our maritime data captures steep losses through the traditional peak shipping season to year-end:

Critics of the U.S.-China Phase One agreement note that, in leaving the tariffs in place and in side-stepping such top-of-agenda issues as China’s subsidies for state-owned enterprises, there is little reason to expect any shift away from the current downward trend in trade in 2020.

It may be that, while this reset in U.S.-China trade relations signals an easing of tensions, it is also a tacit acceptance that, as the Financial Times puts it, the “decoupling” of the world’s two largest and still tightly interconnected economies is underway.

Related:

Blog:

Resources:

In addition to the thousands of HS codes covered by Section 301 tariff lists 1, 2, 3 and 4A-B, the U.S. periodically released lists of HS codes excluded from the Section 301 tariffs, generally because importers have been unable to find suitable substitutes for essential inputs or goods from alternate domestic or foreign sources. The exclusions come with both retroactive and sunset dates. The first exclusions for products on List 1 were granted in December 2018. The most recent exclusions apply to List 3 and were released a year-end 2019. Of the first round of exclusions due to expire December 28, 2019, only the exclusions on six products denoted by 10-digit HS codes were extended into 2020. Keeping on top of fluctuating tariff rates is critical to importers’ bottom lines. Descartes CustomsInfoTM Manager offers a practical solution with end-to-end enterprise software for up-to-date tariff classifications. Learn more >>