Can trade and logistics remake Florida? GIS WebTech has shared with us (via twitter) a story from Brookings that raises this question – and answers with an emphatic yes.

As Brookings points out, many of Florida’s metro areas have yet to recoup the job losses sustained during the Great Recession. The state can leverage its position as a hub for global – and especially Latin American – commerce to grow a more diverse, robust economy.

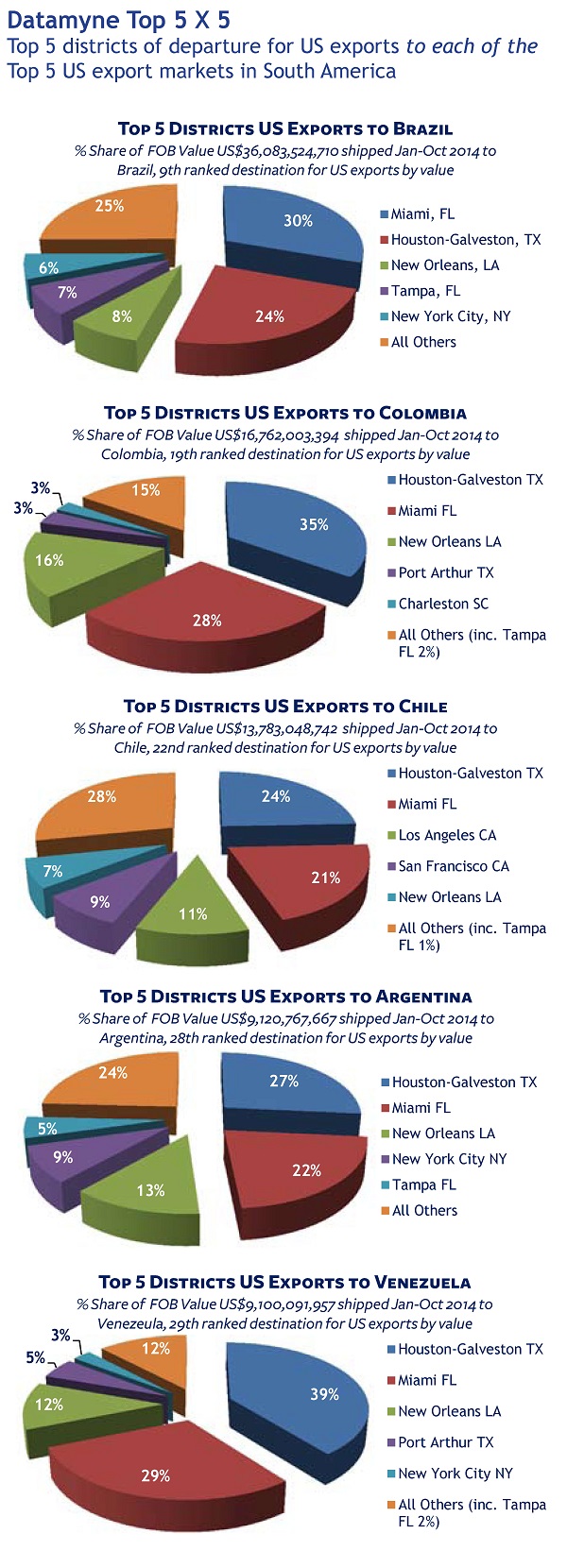

Our trade data confirms Florida’s importance as a conduit for exports to the Southern Hemisphere. See, for example, the Datamyne Top 5X5 (below) on the top five customs districts ranked by the value of US exports bound for each of the top 5 South American export markets in 2014 (January-October). During this same period, 82% of the export trade through the Miami customs district has been headed for South America, Central America and the Caribbean.

But this raises another question: With the commodities boom fizzling out and many South American economies scaling back economic growth projections, does Florida’s position as gateway to Latin America open it to more risk than opportunity in the near future?