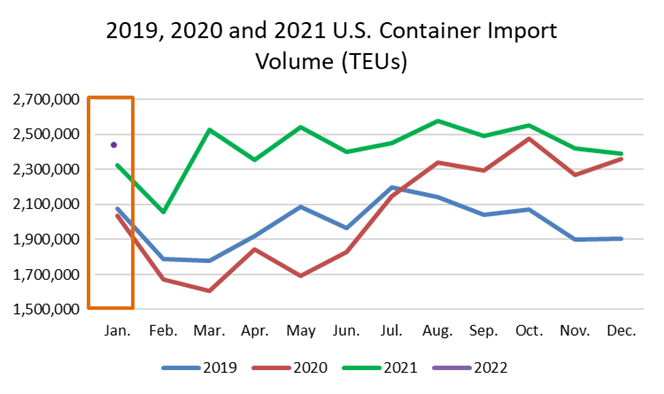

It would not have been outside the realms of possibility to think that the start of the New Year would marked by a lull in U.S. import volume. Afterall the traditionally quieter December month was as frenetic as it has been compared with the previous six months. The truth of the matter is that volumes into the United States remained at record levels in January – above 2.4 million TEUs – as demand for durable goods remained strong, which means that the chronic supply chain disruptions are not likely to abate in the short term.

For the first month of the year, container volume was 3% higher compared with December, 6% up from January 2021 and 14% above the same period in 2020, according to global trade data from Descartes Datamyne. The numbers are in line with the expectations of the logistics community.

Figure #1. U.S. Container Import Volume Year-over-Year Comparison

Shipping, Economic and Other Trends to Note

How are other shippers trying to deal with the supply chain capacity crunch and what’s happening with the economy are questions that many are asking.

- The biggest trend was that shippers, tired of queuing up at some of the busiest ports such as the Port of Los Angeles and Port of Long Beach on the West Coast, tried to shift their trade lanes to other ports, with the biggest beneficiaries being the Port of New York/New Jersey. Other winners, as gleaned from Datamyne U.S. import trade data, included Savannah and Houston.

- Consumer personal expenditures, one of the main drivers fueling high import volumes, softened further for the latest reporting month (December 2021). Observers said that this trend was due to pre-holiday buying that began earlier than usual combined with a slowdown in purchases of durable goods.

- There was a slight improvement in the Retail Inventory to Sales ratio, according to the latest Federal Reserve Economic Data (November 2021), meaning that retailers were able to catch up on refilling depleted inventory positions.

What Businesses Can Do Keep Their Supply Chains Moving

In the face of continued supply chain disruptions, there are two key strategies that could be employed in order to help ensure an uninterrupted supply of goods to customers:

- Short Term: Optimize supply chains by shifting the movement of goods to less congested transport lanes and ports

- Long Term: Strengthen the resiliency of supply chains by sourcing for alternative suppliers

Datamyne can help in both scenarios. Built on the world’s largest searchable trade database and utilizing artificial intelligence, Datamyne is a leading provider of global trade intelligence that customers use to spot supply/demand shifts, optimize trade lanes, expand into new markets, and discover alternative buyers and suppliers.

This is an excerpt of an article originally posted in the Descartes Global Shipping Crisis Resource Center. If you are looking for how Datamyne’s Global Trade Data and Intelligence can help you, Contact Us.