Mexico has been a major trading partner with the United States for decades, however, in recent years, that trade has risen sharply, with China contributing significantly to the increase, according to Descartes Datamyne U.S.-Mexico trade data.

The trend serves to further underline Mexico’s importance to the American economy and follows the U.S. imposition of steep tariff hikes on a range of Chinese goods in 2018.

Key Takeaways

- Mexico is strengthening its position as a major trading partner with the U.S.

- China has shifted its trade flow to the U.S. by going through Mexico.

- Between 2016 and 2022, Mexico shipped 55% more goods to the U.S.

- Over the same period, China’s imports to Mexico jumped 138%.

- The new trend follows U.S. import tariff increases on Chinese goods in 2018.

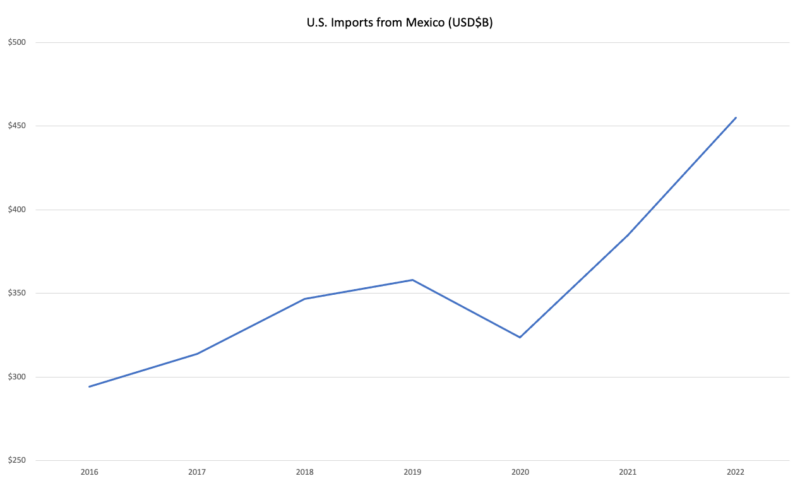

Growth in the Value of U.S.-Mexico Trade

Between 2016 and 2022, U.S. imports from Mexico grew 55% from about $300 billion to more than $450 billion. There was steady growth from 2016 to 2019, punctuated by a decline in 2020 due to the pandemic, followed accelerated gains in 2021 and 2022 (see Figure 1).

Figure 1: Value of U.S. Imports from Mexico 2016-2022

Source: Descartes Datamyne™

The China Factor Contributing to Mexico’s Trade with the U.S.

At the same time, Mexico imports from China soared 138% (see Figure 2), a significant percentage unlikely to have been completely absorbed by the Mexican economy which only grew 3.4% in the seven-year period to 2022. A better bet to make is that a major proportion of these shipments was earmarked to produce goods in Mexico that were ultimately destined for the U.S.

This growth is being driven not only by Chinese companies, but any multinational using Mexico as a lower cost manufacturing source for U.S.-bound goods.

Figure 2: Mexico Imports from China

Source: Descartes Datamyne™

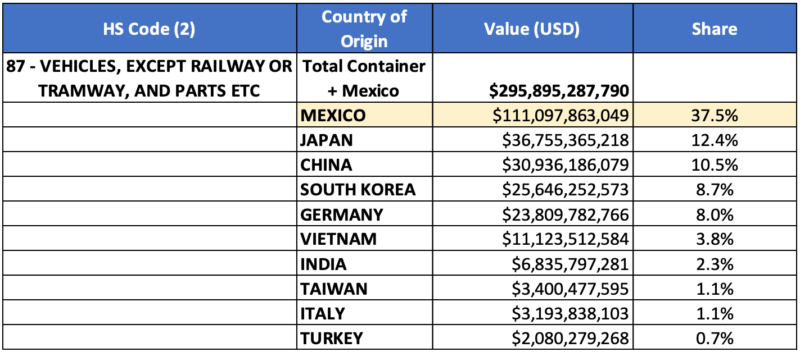

U.S.-Mexico Trade in Vehicles and Related Parts

But how far is China imports to Mexico actually fueling the Latin American nation’s growth in trade with the U.S.? Let’s take a look at HS-87 goods, representing trade in vehicles and related parts, except railway or tramway.

At 38% share of the U.S. market in 2022, Mexico was the biggest supplier of HS-87 goods (see Figure 3). Between 2016 and 2022, the total value of goods in this category shipped to the U.S. jumped 49%, with the largest year-on-year increase of 23% occurring in 2022. The value of U.S. maritime imports increased 30% in the seven-year period under review, implying that Mexico gained market share in the HS-87 sector.

Meanwhile, China imports of HS-87 goods into Mexico between 2016 and 2022, climbed an impressive 282%. It’s apparent that China now represents a significant percentage of the value of U.S. imports from Mexico. For HS-87 (vehicles and related parts, etc.) in particular, the percentage of Chinese exports to Mexico is most likely underrepresented as U.S. imports from Mexico include vehicles, not just parts, and account for multiple moves across the U.S. and Mexican borders.

Figure 3: Top 10 Country of Origin Analysis for HS-87 Goods in 2022

Source: Descartes Datamyne™

In Conclusion

The analysis shows that Mexico’s accelerated growth of Chinese imports over 2021 and 2022 has helped enhance its position as one of the top countries of origin for U.S.-bound goods. It also tracks a shift in trade flow resulting from the 2018 U.S.-imposed tariffs on China, which together with the continuing effects of the pandemic trade flow disruptions, underlines the view that U.S.-Mexico trade will likely remain at these elevated volumes for the foreseeable future.

This is an excerpt of an article by Descartes Systems Group’s Chris Jones entitled Growth in Mexico’s Exports to the U.S. and the Rising Importance of Chinese Goods Supporting it.

How Datamyne Global Shipping Data can Help Manage Supply Chain Risks

Descartes Datamyne delivers global trade and shipping data with comprehensive, accurate, up-to-date, import information that helps companies save significant time in spotting supply and demand shifts, optimizing trade lanes, expanding into new markets and identifying new buyers and suppliers.

Datamyne features the world’s largest searchable trade database covering 230 markets across five continents. Gathered directly from official filings with customs agencies and trade ministries, including bills of lading, our data is detailed (down to company names and contact details), timely and authoritative.

Apart from providing trade intelligence via shipping data, Descartes software solutions also include a landed cost tool to calculate the economic viability of importing from a range of markets. Our applications can also screen against multiple denied parties lists simultaneously to help ensure organizations are not doing business with entities named on official government watch lists.

This is an excerpt of an article originally posted in the Descartes Global Shipping Report Resource Center. If you are looking for how Datamyne’s global trade and shipping data can help you, Contact Us.