Speculative rumors produce real increases, although not nearly as big as 2003

Last month, a flurry of headlines, starting with a report in the UK’s Telegraph, warned that the wholesale price of vanilla was set to rise sharply – adding as much as 10% to the retail price of a vanilla ice cream cone this summer.

Within days, the primary source cited in the Telegraph’s story – Nick Peksa of market analysts Mintec – was resetting the forecast for a price spike from “likely” to just “possible”.

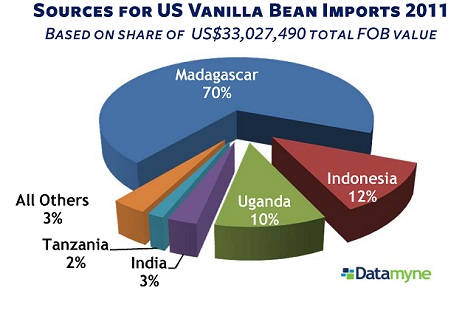

Shortfalls in Mexican and Indian production seem to have prompted some stockpiling of vanilla from Madagascar. But, as Madagascar accounts for from two-thirds to 80% of global output, the impact of poor harvests in a couple of the several countries that contribute the other 20-30% should be modest.

Right now, says Peksa, the market for vanilla has “nicely balanced” supply and demand. This equilibrium might be upset by an event in Madagascar, such as a hurricane or political unrest, and vanilla prices could move up, perhaps double, but will go nowhere near as high as 2003.

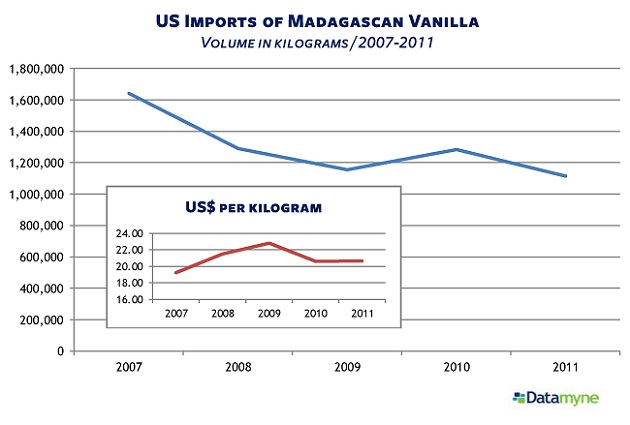

Indeed, the price of vanilla reached a peak of $500 per kilogram in 2003. The current price is estimated to be approaching $40/kilogram, up from the $20/kilogram vanilla’s been stuck at for the last six years.

Both extreme weather and political unrest were the immediate causes of the stratospheric price climb of 2003. But, really, this period marked the final loosening of the old regime’s grip on the country … and its economy. Through the 1990s, Madagascar’s vanilla producers, farm-gate prices and export volumes were closely regulated and, by extension, so was the global vanilla market.

As in 2003, Madagascar is still the leading vanilla producer and the small market remains vulnerable to speculative price swings. There are some important differences in the 2012 market, however. When prices peaked, global consumption of vanilla beans fell by half. Estimates vary, but the natural product seems to have permanently lost a third of its previous (already minority) market share to synthetic substitutes.

The last six years of low prices have caused Madagascan farmers to neglect vanilla – derived from the pods of orchids that must be pollinated, harvested, processed, sorted and graded by hand – in favor of more profitable crops.

Meanwhile, new countries are entering the market for vanilla. These include countries such as Uganda and Tanzania that have been encouraged by agencies such as USAID to cultivate this high-value labor-intensive crop for export. At $20/kilogram, the value doesn’t seem so very high for all the labor involved. And, in fact, the Fair Trade minimum price at the source is about $40/kilogram (where today’s higher market prices are headed) plus a $6 premium for local community development, for a total minimum price to the buyer of $46/kilogram.

Datamyne’s trade data confirms vanilla’s flat-line price and the fall-off in vanilla shipped from Madagascar to the US, the world’s largest consumer of vanilla, over the last five years.

The data on last year’s imports indicates the rising significance of Uganda’s vanilla exports (10.5% in 2011 compared to 8.8% in 2010) as well as the success of USAID. Tanzania, another USAID beneficiary, also makes the top five, in its very first year of exporting vanilla to the US.

Top US importers, based on first-quarter volumes, are Roukia Trading; Firmenich Inc.; Tripper, Inc.; Dammann & Co., Inc.; and Peru Food Import, Inc. To find out what else you can learn about vanilla – or any other ingredient in trade – contact us, or speak to one of us by clicking “live chat” on our homepage.