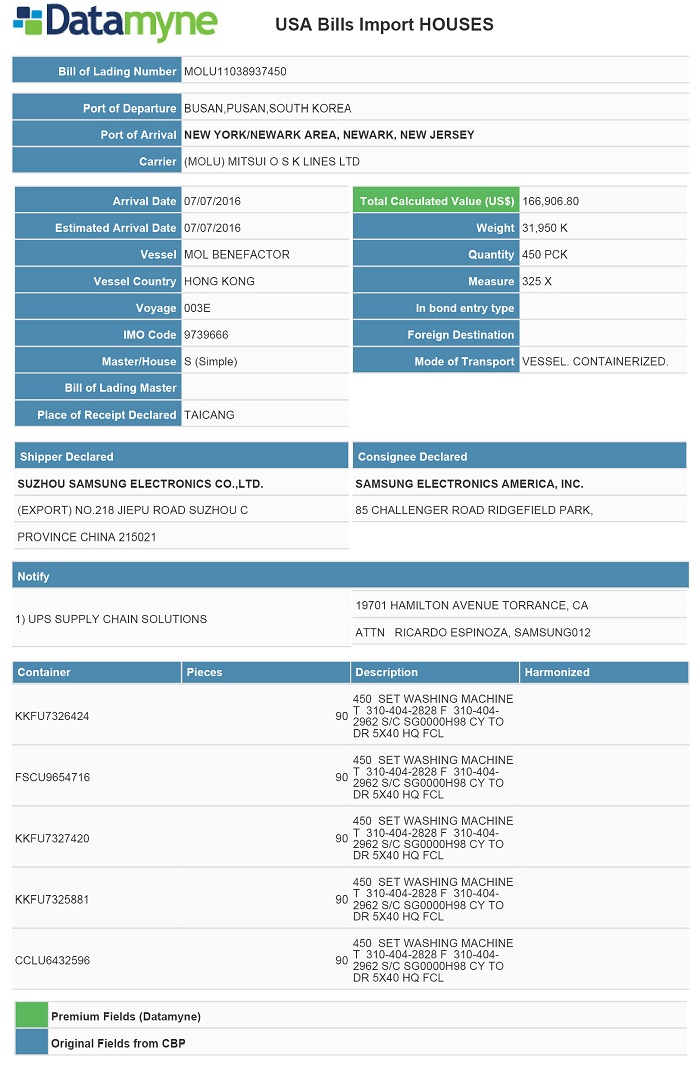

The first super-sized cargo vessels to pass through the newly expanded Panama Canal have begun arriving in ports along the East Coast – starting with the MOL Benefactor.

The Mitsui O.S.K. Lines neopanamax containership made the first commercial transit through the canal’s wider locks July 1 and arrived at the Port of New York-New Jersey July 7. Capable of carrying 10,000 TEUs (twenty-foot equivalent units, the standard measure of shipping container volumes), the MOL Benefactor is freighted with more than the cargo recorded in the bills of lading (see one of the bills below).

This voyage may set in motion a new global trade dynamic that will shift Asian import traffic now received at West Coast ports over to the East Coast. The all-water route direct to the East Coast via the canal can save five days compared with cross-country overland transport from the West Coast, as Port Technology reports.

Still, don’t expect to see the East Coast overtaking West Coast ports in imports any time soon.

For one thing, many East Coast ports aren’t quite ready for the dawning neopanamax era. Start with the coast’s biggest port, NY-NJ. The MOL Benefactor unloaded at the Bayonne Global Container Terminal, the only major port terminal outside the Bayonne Bridge, which is too low to admit neopanamax vessels to the inner harbor. The port is working on raising the bridge, but the project completion date has just been postponed until late 2017.

In contrast, the Port of Miami had completed its infrastructure improvements and was “Big Ship Ready” to welcome its first neopanamax, the MOL Majesty, July 9. Baltimore has deepened its shipping channel, but the ports of Savannah and Charleston are still dredging.

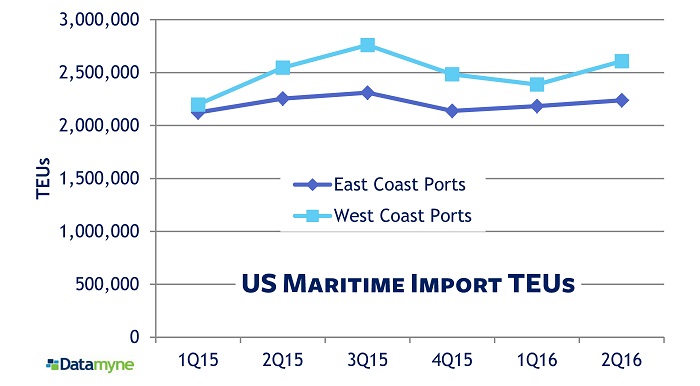

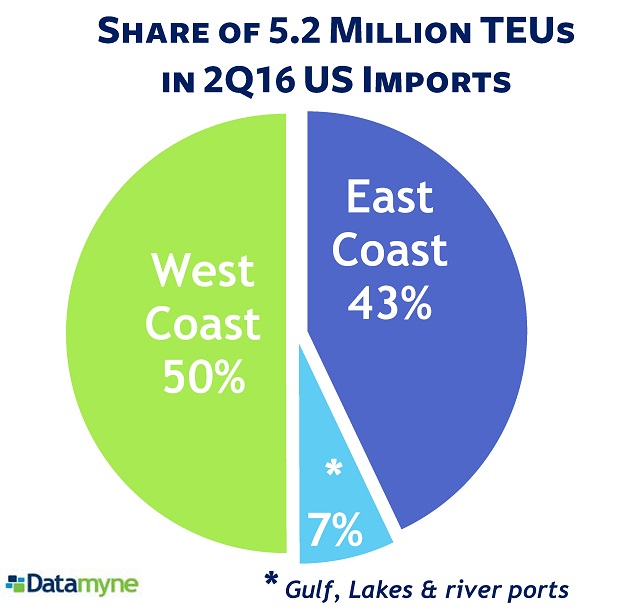

Early on in 2015, it seemed the East and West Coasts were on track to achieving parity in containerized import volumes. That shift in share of TEUs from the West to East now seems to have been largely the result of the West Coast’s labor woes. [See, for example, West Coast Ports Strike Back.] Our latest data shows a return to more traditional shares. The West Coast is clearly ahead in the second-quarter 2016 split of TEUs:

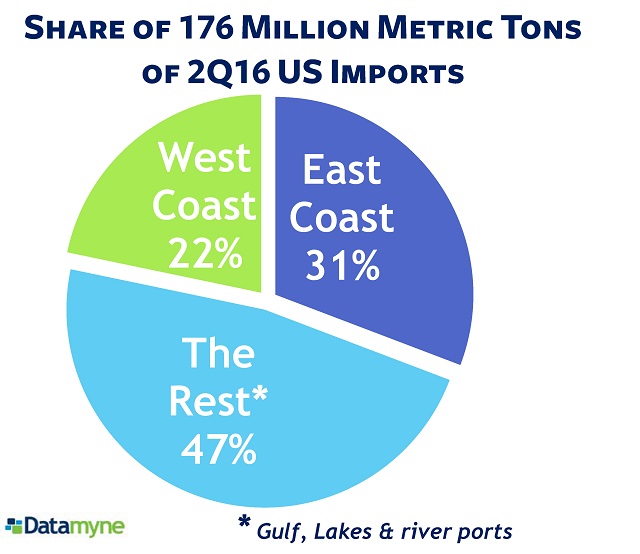

We’ll have to wait and see whether the neopanamax era sets the stage for the East Coast overtaking the West Coast ports’ share of import volumes … and we’ll keep tracking the quarterly data here. Just to put the West vs. East Coast TEU rivalry in perspective – this break-out of second-quarter imports by metric tons gives full due to the non-containerized imports handled by the Great Lakes and, especially, the Gulf ports:

Historic document: A bill of lading documenting a shipment aboard the MOL Benefactor, first neopanamax vessel to make a commercial transit through the expanded Panama Canal.

Related: