While the early rounds of US sanctions aimed at getting Russia to rethink its Crimea strategy have been confined to a small circle of government insiders and banking institutions, President Obama has signed an executive order that clears the way for sterner measures, including blocks on trade in key economic sectors. Financial services, energy, metals and mining, engineering, and defense and related materiel are listed as potential targets.

Inevitably, trade sanctions on Russia will impact sectors and trade partners in the US. We turned to our data to identify markets and industries that would feel any interruptions in Russian trade.

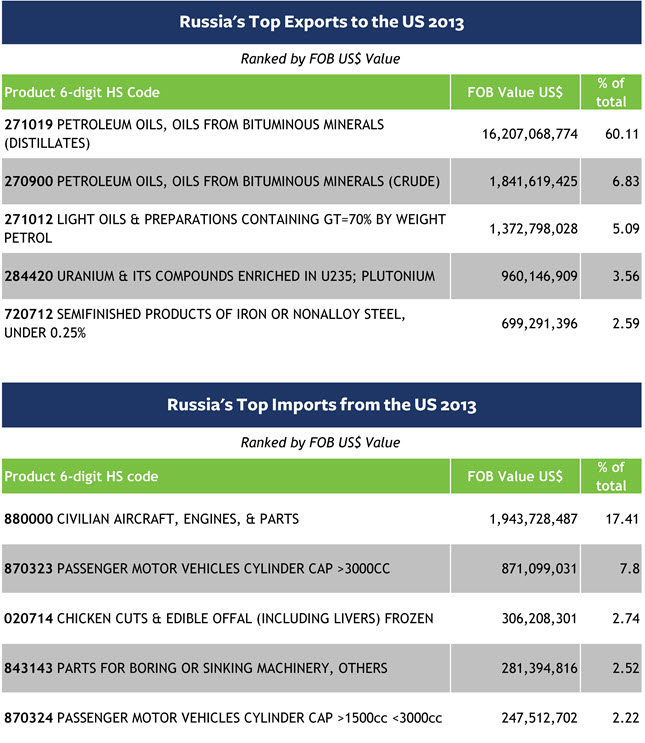

Russia ranked 18th as a source of US imports in 2013, with shipments valued (FOB US$) at $26,961,498,68, accounting for 1.19% of US imports. It ranked 28th as a destination for US exports, taking delivery on $11,164,046,604 worth of trade goods, or 0.71% of US exports. Here are the top commodities in US-Russia trade:

The Obama administration’s focus on the energy sector comes as no surprise, as oil accounts for the lion’s share of Russia’s exports to the US. Metals, also on the target list, rank next as Russian exports – while Russia’s ability to mine them would be harmed by a halt in US exports of “parts for boring or sinking machinery,” ranked fourth among Russia’s top US imports. Of course, this would also dent sales by US exporters of this equipment.

The Obama administration’s focus on the energy sector comes as no surprise, as oil accounts for the lion’s share of Russia’s exports to the US. Metals, also on the target list, rank next as Russian exports – while Russia’s ability to mine them would be harmed by a halt in US exports of “parts for boring or sinking machinery,” ranked fourth among Russia’s top US imports. Of course, this would also dent sales by US exporters of this equipment.

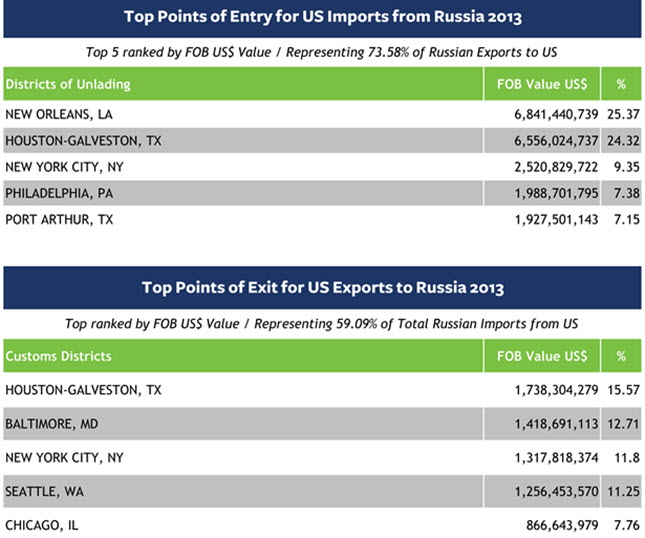

Digging a little deeper, we looked at the US regions that handle the flow of trade with Russia:

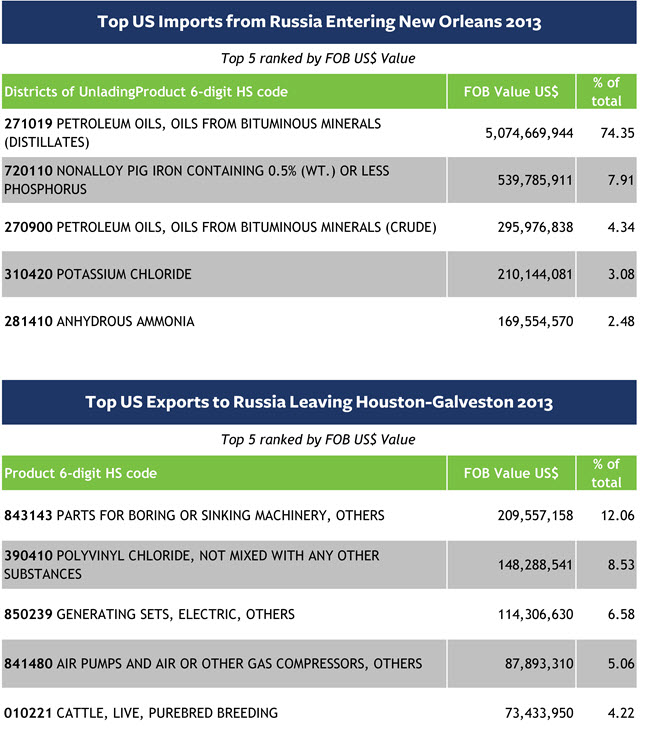

Take a look next at the mix of trade commodities moving in via New Orleans and out through Houston-Galveston:

Take a look next at the mix of trade commodities moving in via New Orleans and out through Houston-Galveston:

The data indicates that Houston-Galveston, which handles $209,557,158 (of a total of $281,394,816) in US exports of parts for mining machinery, would bear the brunt of any interruption of trade in this commodity, even as New Orleans, point of entry for about a third of Russian petroleum, would miss this import.

The data indicates that Houston-Galveston, which handles $209,557,158 (of a total of $281,394,816) in US exports of parts for mining machinery, would bear the brunt of any interruption of trade in this commodity, even as New Orleans, point of entry for about a third of Russian petroleum, would miss this import.

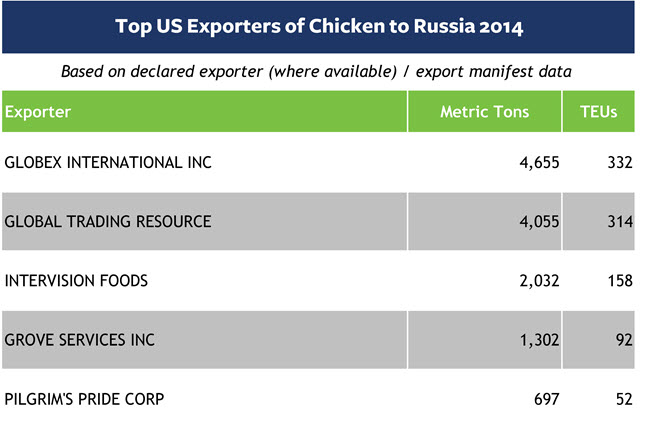

We looked at our export manifest data to see who would be vulnerable to a suspension of sales of chicken to Russia (note that food is NOT currently on the table when it comes to sanctions).

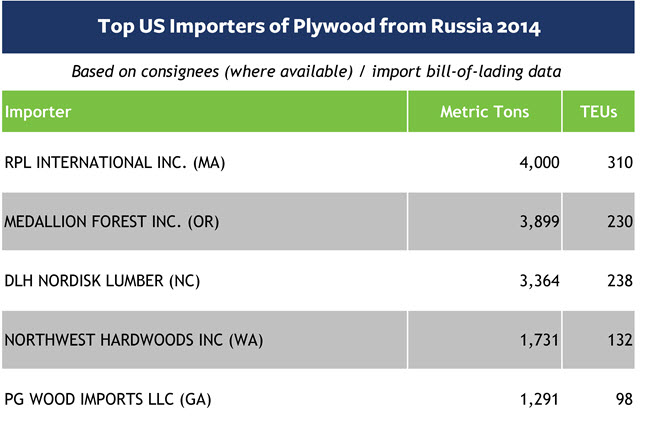

And we looked at our US import bill-of-lading data to find importers currently sourcing plywood (ranked 16th)* from Russia.

And we looked at our US import bill-of-lading data to find importers currently sourcing plywood (ranked 16th)* from Russia.

If you would like to see what our trade data can reveal about the potential impact of sanctions on Russia (or any other disruption of trade) on your sector or product, just ask us.

If you would like to see what our trade data can reveal about the potential impact of sanctions on Russia (or any other disruption of trade) on your sector or product, just ask us.

*Originally posted as 18th, plywood in fact ranked 16th among US imports from Russia in 2013.