But unfreezing trade will take time

We’ve written before on the diplomatic tit-for-tat that virtually shut down commerce between Colombia and Venezuela.

After the erstwhile trading partners called it quits in July 2009, binational trade fell by more than 60%. One year later, newly elected Colombian President Juan Manuel Santos reported that both sides were ready to renew their ties.

Now Venezuela is once again importing food and other necessities from Colombia, having agreed to pay debts owed to Colombian exporters.

As Caracas’s El Universal reports, while progress continues, it may take a year or more to restore trade relations. More, renewed trade “does not mean that it will be in previously reported volume. Not everything is as usual. Nothing is so automatic,” says Luis Alberto Russián, CEO of Cavecol, the Venezuelan-Colombian Chamber for Economic Integration. “It has to do with Venezuela’s purchasing power, with the new markets and suppliers contracted by Colombia during that term.”

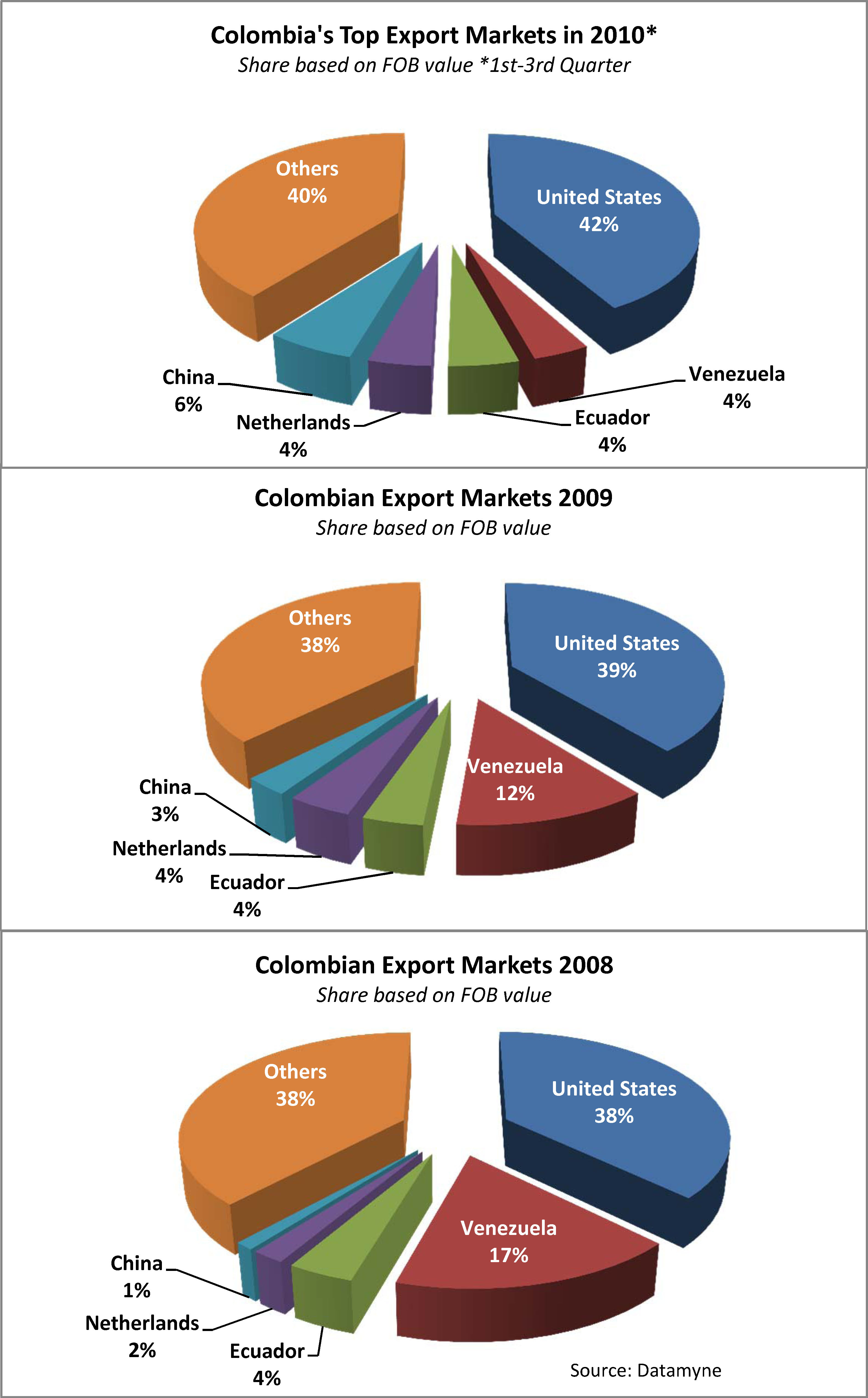

Indeed, Colombia has been hard at work diversifying its export markets. As Datamyne trade statistics confirm, China overtook Venezuela as the second-ranked destination for Colombian exports last year.

With Santos’s Development Plan for the next four years calling for stronger trade ties with the Asia-Pacific region, a return to the export market mix of 2008 seems unlikely. Certainly, as the only South American nation facing both the Pacific and the Atlantic oceans, the opportunity is there for Colombia to penetrate markets in the East as well as the West.

It should be noted that, as Colombia Reports points out,the country’s main Pacific coast port, Buenaventura, is in desperate need of new and expanded infrastructure and faces impressive competition for Asia-Pacific trade. Ecuador is investing heavily in its port at Manta so that it may become “China’s gateway to Latin America.” At the same time, Peru is promoting its modernized port of Callao for that role, and Argentina is planning investments to keep Valparaiso and San Antonio competitive.