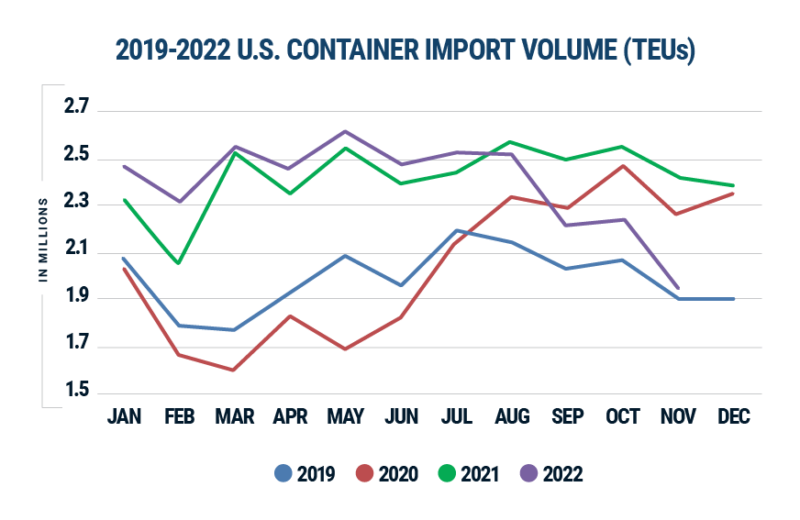

U.S. container imports fell 19.4% in November to 1.9 million Twenty Foot Equivalent Units (TEUs) compared with the same month in 2021, according to global trade and shipping data from Descartes Datamyne.

It is the first time in almost two years that volumes have dipped below the two million TEUs-a-month mark, bringing inbound throughput to almost 2019 levels. (See Figure 1). However, it is still too early to say if we have turned the corner, as key economic indicators–economic growth, jobs, inflation, interest rates, fuel costs–are sending mixed signals on what the future trend might be.

November shipping data shows imports from China continuing to decline, with other major trading partners such as Vietnam and Thailand posting more significant drops. The retreats come amid additional data pointing to people spending for their end-of-year holiday shopping earlier in the year compared with previously.

Figure 1: U.S. Container Import Volume Year-over-Year Comparison

Source: Descartes Datamyne™

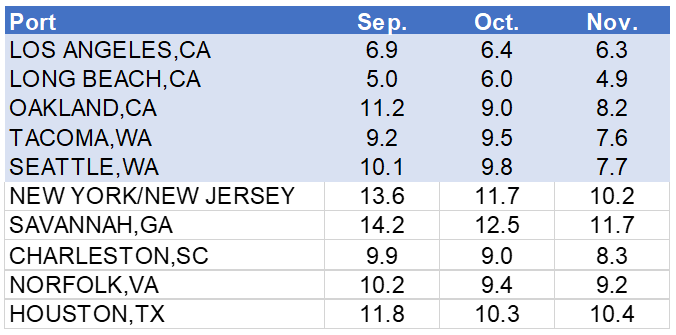

Shipping Data Shows Port Delays Also Continuing to Decline

Delays in processing container traffic further improved as import volumes continued their downtrend since August. (See Figure 2). Major West Coast ports tracked well below 10 days in November, with the Port of Long Beach leading the way at about five days. Delays at major East and Gulf ports also made gains but wait times are still longer compared with their counterparts on the West Coast. This is highlighted by the fact that delays at the ports of Savannah, Houston and New York/New Jersey remain above 10 days.

Figure 2. Monthly Average Delays (in days) at the Top 10 U.S. Ports

Source: Descartes Datamyne™

Note: Descartes’ definition of port delay is the difference as measured in days between the Estimated Arrival Date, which is initially declared on the bill of lading, and the date when Descartes receives the CBP-processed bill of lading.

Macroeconomic Issues Persist

Global shipping data from Descartes Datamyne continue to show more container traffic shifting to East and Gulf Coast ports compared with West Coast ports, freeing up capacity in the latter maritime transportation hubs. The trend is driven by fears of major work stoppages by dock workers on the West Coast including the ongoing negotiations to renew the International Longshore and Warehouse Union (ILWU) contract which expired on July 1st, and the California law AB5 for which there is no resolution in sight. Fortunately, labor strife appears to be in check at this point in time.

Meanwhile, the U.S. economy grew a respectable 2.9% in the third quarter compared with the second. Employment increased by 263,000 jobs in November, which kept unemployment close to record lows at 3.7%. Also in November, inflation remained high but eased to 7.7% on retreats in gasoline costs and the knock on effects of the series of interest rate hikes since the beginning of this year.

Managing Supply Chain Risks with Global Shipping Data

With the downtrend in U.S. container imports since August, the question on everyone’s mind is whether inbound shipping volumes will be returning to pre-pandemic 2019 levels in 2023. However, all the major indicators points to continued uncertainty ahead. Although the U.S. economy is back in the black reversing two quarters of contractions, inflation remains stubbornly high which in turn raises the specter of yet further interest rate hikes.

Meanwhile, the risk of emerging supply chain disruptions continues to be high. For example, although the Chinese government has moved to start relaxing its tough lockdown policies to combat new COVID outbreaks in the country, these measures are still fairly restrictive, and time will tell if China can get control of the problem without severely impacting global supply chains. At the same time, the ongoing Russia-Ukraine war continues to cast a shadow on international trade, making the return to normal business operating conditions all the more challenging.

To alleviate stress, shippers and logistics providers have strategies they can deploy, including using global shipping data to mitigate supply chain risk with the key objective of keeping their international business healthy and growing, and maintaining a satisfied customer base. These strategies include:

- Short Term: Optimize supply chains by shifting the movement of goods to less congested transport lanes and ports. According to Descartes Datamyne trade and shipping data, there appears to be greater capacity in West Coast ports compared with their East and Gulf Coast counterparts.

- Long Term: Strengthen the resiliency of supply chains by sourcing for alternative suppliers.

The idea here (and, again, tapping into shipping data) is to diversify the base of suppliers to multiple countries to lessen the risk of supply chain shocks, and to have alternative sources of good, parts and raw materials that feed into both East and West Coast ports.

How Datamyne Global Shipping Data can Help Manage Supply Chain Risks

Descartes Datamyne delivers global trade and shipping data with comprehensive, accurate, up-to-date, import information that helps companies save significant time in spotting supply and demand shifts, optimizing trade lanes, expanding into new markets and identifying new buyers and suppliers.

Datamyne features the world’s largest searchable trade database covering 230 markets across five continents. Gathered directly from official filings with customs agencies and trade ministries, including bills of lading, our data is detailed (down to company names and contact details), timely and authoritative.

Apart from providing trade intelligence via shipping data, Descartes software solutions also include a landed cost tool to calculate the economic viability of importing from a range of markets. Our applications can also screen against multiple denied parties lists simultaneously to help ensure organizations are not doing business with entities named on official government watch lists.

This is an excerpt of an article originally posted in the Descartes Global Shipping Crisis Resource Center. If you are looking for how Datamyne’s global trade and shipping data can help you, Contact Us.

Note: This report uses the initial compiled release of U.S. Customs and Border Protection (CBP) data and is subject to revision at a later date by CBP. The revised data can be seen in Descartes Datamyne.