Download the free January 2023 report on U.S. tire imports that accompanies this article.

Descartes Datamyne trade data gauges the impacts of the post-pandemic recovery, supply chain disruptions, trade policies, and climate change measures on cross-border commerce in tires.

Tires are a bellwether product in U.S. merchandise trade. Year-after-year, new pneumatic tires of rubber [denoted by 4011 in the Harmonized System of tariff codes] consistently rank 26th or higher among U.S. imports by value. With a domestic market divided between original equipment manufacturing (OEM) sales and fleet contracts on one hand, and the aftermarket for replacement sales on the other, inbound shipments of tires offer clues to trends within the automotive industry and among consumers.

Here is the Descartes Datamyne trade data on annual import and export trade volumes from pre-pandemic 2019 through last year:

Figure 1 U.S. Import-Export Trade in New, Used and Retread Tires 2019-23

![U.S. Import-Export Trade in Tires, Old [HS4012] and New {HS4011] 2019-2023](https://www.datamyne.com/wp-content/blogs.dir/1/files/2024/03/Figure-1-us-Import-Export-Trade-in-Tires-Old-HS4012-and-New-HS4011-2019-2023-800x613.png)

Source: Descartes Datamyne Census Data on HS4011, 4012 / General Quantity

Pandemic shutdowns caused the year-over-year drops in shipments in 2020. Except for exports of new tires, U.S. tire trade volumes recovered in 2021, despite serious delays caused by supply chain congestion. Import shipments of new and used tires climbed further in 2022 on the expectation of a surge in pent-up demand. Unfortunately, over-exuberant stocking resulted in inventory overhangs, dampening import orders in 2023. [This was a situation faced by many U.S. importers of consumer merchandise – see, for instance, Mainstay of Peak Shipping, Toys Face Headwinds].

There is another possible explanation for the 2022 bump-up in new tire imports. Several labor unions have petitioned the U.S. International Trade Commission for relief from tires they say were dumped on the U.S. market in 2022 by Thailand.

Preliminary testimony in the USITC investigation [No. 731-TA-1658] offers a view into the current state of the tire market. The labor unions say that recent cutbacks in production and shelved plans to expand capacity are evidence that U.S. tiremakers have been injured by the influx of Thai truck and bus tires priced below market rates.

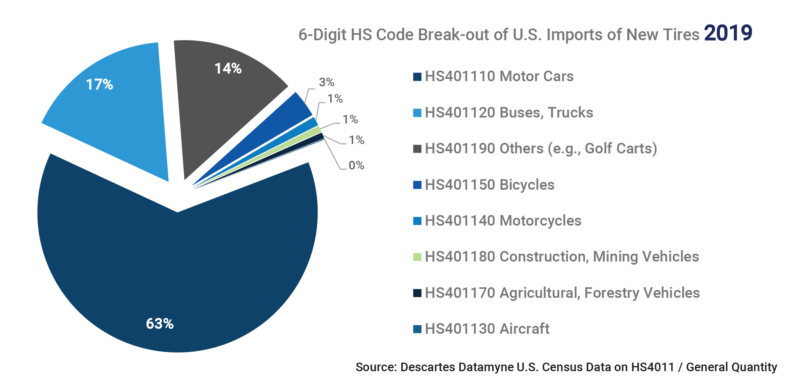

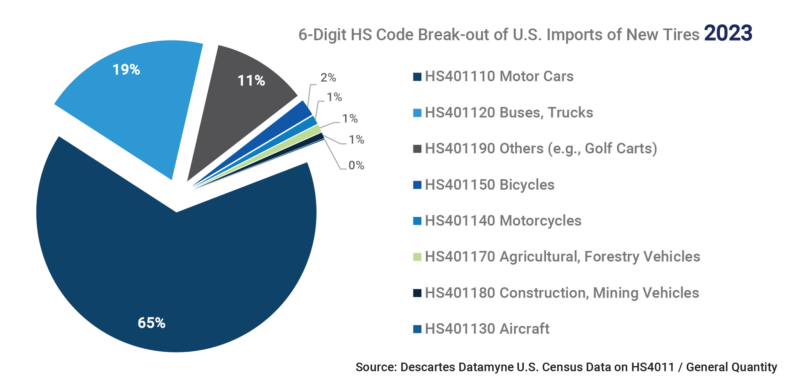

Referred to as commercial or TBR – for truck, bus radial – tires, this product category accounts for a big, and growing, slice of U.S. tire imports. Passenger car radial – or PCR – tires account for the lion’s share of U.S. imports, as shown in the Descartes Datamyne data, here comparing trade in pre-pandemic 2019 with 2023:

Figure 2 Break-out by Product Category of U.S. New Tire Imports in 2019

Source: Descartes Datamyne U.S. Census Data on HS4011 / General Quantity

Figure 3 Break-out by Product Category of U.S. New Tire Imports in 2023

Source: Descartes Datamyne U.S. Census Data on HS4011 / General Quantity

Opponents of new import tariffs counter that tire production has generally been close to capacity at 90% during the investigation period (2020 through 2022). In any event, the Thai tires are not in direct competition with the Tier I and Tier II tire makers’ pricier, name-brand products, which are mostly sold through contracts with OEMs and large fleets. The Thai tires’ market niche is Tier III – value-priced generics sold to dealers and, ultimately, independent truckers. Domestic makers of Tier III tires have reported that, having maxed out on production capacity, they relied on imports to meet customer demand, driven in part by increased price sensitivity as inflation has soared.

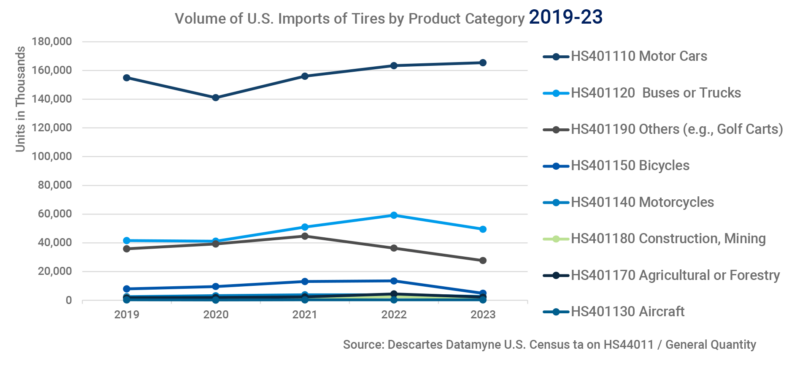

The Descartes Datamyne trade data suggests that the flow of tire imports across all product categories slowed in 2023 – with the notable exception of PCR tires.

Figure 4 Volume of U.S. New Tire Imports by Product Category 2019-2023

Source: Descartes Datamyne U.S. Census Data on HS44011 / General Quantity

Government trade policies reshape global markets

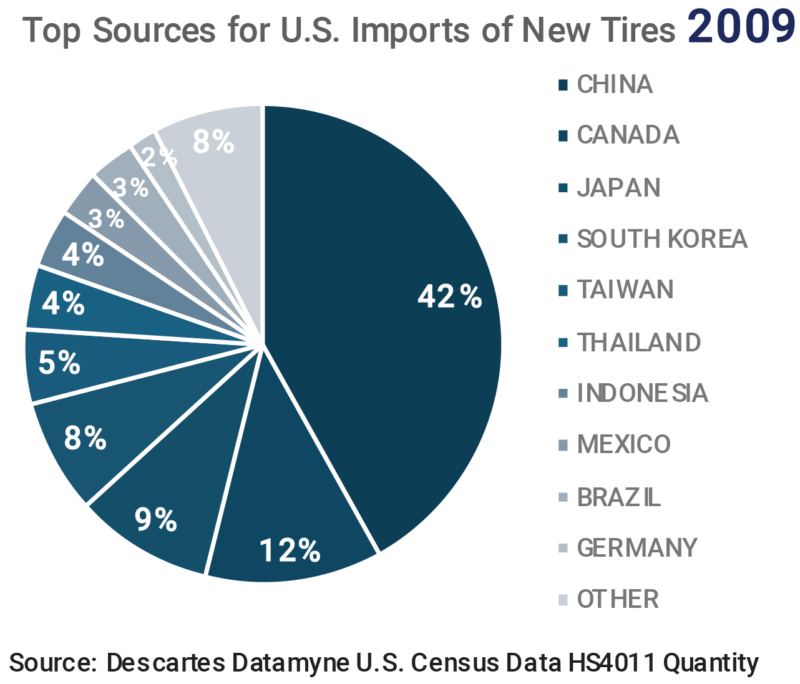

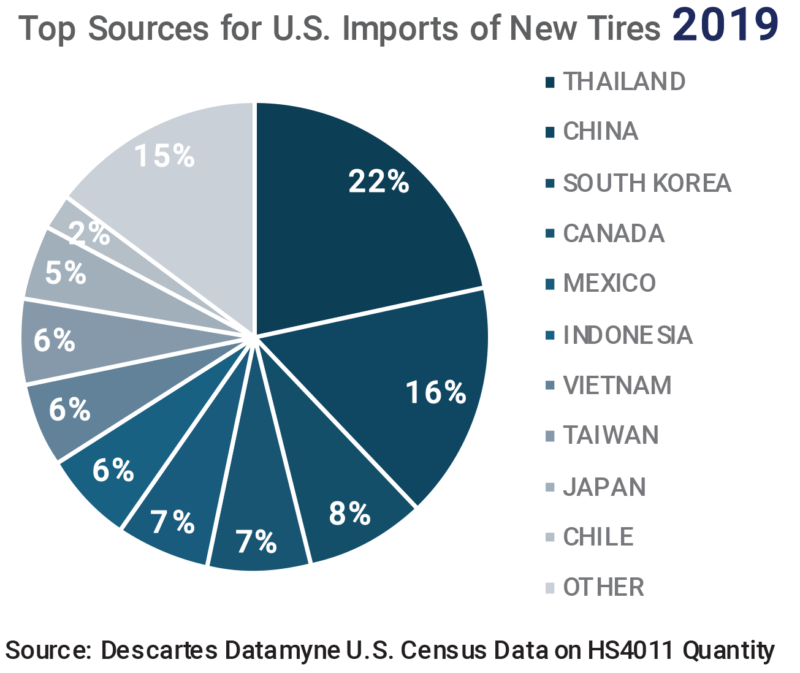

The petitioners seeking tariffs on Thai TBR tires point to the effectiveness of antidumping penalties first imposed on Chinese imports in 2009 as competitive game-changers. In retrospect, these tariffs marked the beginning of the U.S. shift in trade policy toward China. The Descartes Datamyne data measures China’s receding and Thailand’s growing share as the U.S. drive to “de-couple” from China continues. Compare the difference between the 2009 and 2019 rosters of countries of origin for U.S. tire imports:

Figure 5 Top Countries of Origin for U.S. New Tire Imports in 2009

Source: Descartes Datamyne U.S. Census Data HS4011 Quantity

Figure 6 Top Countries of Origin for U.S. New Tire Imports in 2019

Source: Descartes Datamyne U.S. Census Data on HS4011 Quantity

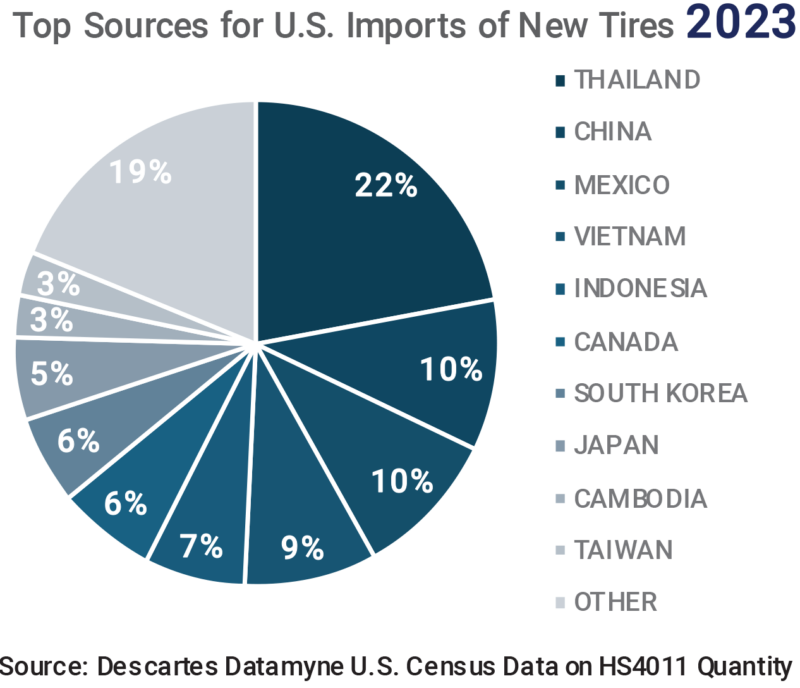

Below, the most recent year’s data shows Mexico poised to surpass China as a supplier to its U.S.-Mexico-Canada Agreement (USMCA) partner, with each claiming 10% of this market. The USMCA – and the North American Free Trade Agreement before it – aimed to encourage continental supply chains.

Figure 7 Top Countries of Origin for U.S. New Tire Imports in 2023

Source: Descartes Datamyne U.S. Census Data on HS4011 Quantity

Not surprisingly, the Descartes Datamyne data suggests that much of the U.S.-Mexican trade in tires is between related parties – that is, subsidiaries or affiliates within multinational organizations (in this case under the umbrella of recognized brand names). This data is drawn from bills of lading, which yield additional information about individual transactions, including the identities of the buyers and sellers; and descriptions, values and quantities of the goods in trade.

Retooling an Industry to Counter Climate Change

Beyond trade policies, national regulatory strategies designed to slow climate change and mitigate its effects have a direct impact on tiremakers and dealers.

According to the International Energy Agency’s 2021 tally, more than 20 countries have announced the full phase-out of internal combustion engine (ICE) car sales over the next 10‑30 years. More than 120 countries (accounting for around 85% of the global road vehicle fleet, excluding two/three-wheelers) have committed to achieving economy-wide net-zero emissions within the next few decades.

Top tier tiremakers have already launched product lines for the electric vehicles (EVs) that are intended to replace ICE cars. Because EVs perform differently from gas-powered vehicles, traditional tires are not a good fit. (In fact, one manufacturer claimed EVs could wear standard tires 30% faster, according to trade publication Elektrek.) As with the auto industry they supply, tiremakers are betting their futures on an increasing market for EV compatible tires – not at all a sure thing, even with government mandates, as U.S. auto dealers with EV inventory overhangs have found.

Meanwhile, environmental regulators are turning their attention from tailpipe emissions to the particulates released by tires. As the FT reports, the European parliament voted to dial back proposed tighter restrictions on fossil fueled emissions, but approved new curbs on the microplastics shed by brakes and tires. The new Euro 7 regimen applies to EVs as well as ICE vehicles.

How to Use Trade Data to Track Tires

How things play out in global markets – for the tire industry, the automotive sector, the electrification of transport – can be tracked by Descartes Datamyne trade intelligence, which is drawn from multiple international databases, and offering the granular details mined from bills of lading.

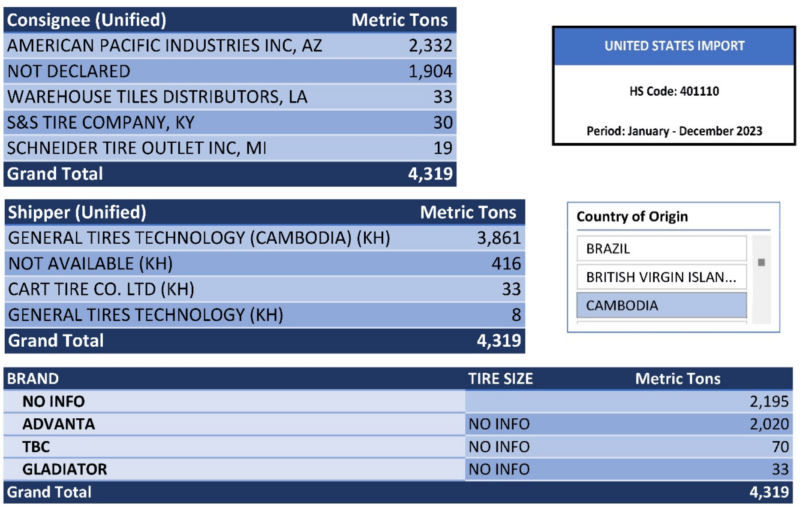

Our new report on U.S. imports of PCR tires [denoted by HS401110] provides a comprehensive view of the consignees and the shippers engaged in this trade in 2023 – and includes the brands and sizes of tires shipped (where available: in this report, bills with this level of detail cover approximately 54% of the year’s waterborne import volume).

The scope and depth of the data offer insight into what’s driving the rise and fall of trade. For instance, one of the surprises revealed by the Census data is Cambodia’s appearance among 2023’s top 10 countries of origin for U.S. tire imports [see the chart above]. In 2021, no tires shipped from Cambodia. Our report points to the explanation: a new plant opened in Cambodia by a China-based tiremaker.

Figure 8 Sample Data on U.S. New Tire Imports from Cambodia in 2023

Enhance Supply Chain Visibility with Descartes Datamyne Global Trade Analytics

Global trade analytics offer a bird’s-eye view of trade flows and hubs for companies prioritizing supply chain resilience. Descartes Datamyne Global Trade Analytics (GTA) leverages all our data assets – based on records sourced from 58 trading nations accounting for nearly 80% of world trade – to provide comprehensive views of import and export trade flows, markets and shipping hubs, volume and value trends.

GTA leverages Microsoft Power BI capabilities to streamline and automate the fundamentals of data research. Rules of work, search parameters and filters, visualizations, report formats and frequencies – all the “preliminaries” can be saved to be run automatically as needed. Overviews and variance analyses are provided.

Of special value in the quest for de-risking and diversification strategies, GTA results can be centered on global statistics or company names, making it possible to trace not only the what, when, and where of trade up and down supply chains, but the buyers and sellers who are parties to the trade.

Ask us for a free, no-obligation demonstration.

You can download a free sample of the trade intelligence from our 2023 report on U.S. tire imports. Or contact us to see more data on tires – or any other product in trade – in a free online demo.