The International Monetary Fund (IMF) is calling for more diversity in global value chains as a means to boost supply chain resilience. Meanwhile, Descartes Datamyne trade data confirms the point that diversification reduces losses to supply disruptions. Moreover, our global trade intelligence can help sharpen and implement supply chain diversification strategies.

Tested by pandemic lockdowns, worldwide shipping gridlock, and wildly fluctuating markets, the global trading system has proven it can absorb the shocks and bounce back quickly, according to the IMF. Surveying the trade data, it finds that goods imports were larger in 2020 than forecasts based on demand and relative price alone.

IMF analysis detailed in its latest World Economic Outlook shows that some supply chains are more shock-proof and more resilient than others because they can count on more supply sources and more of what the IMF calls input substitutability – that is, the ease with which supplies from one source can be substituted for supplies from elsewhere.

Broad benefits of diversity in supply chains

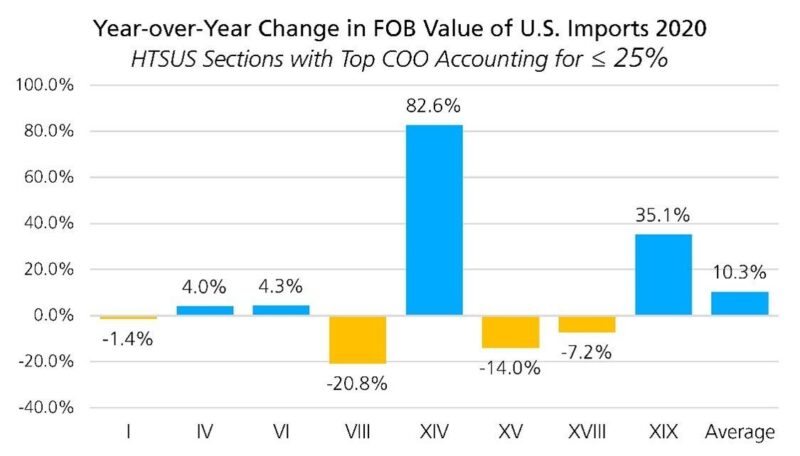

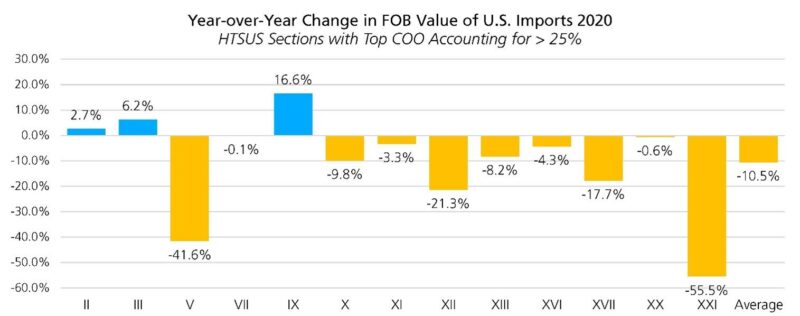

Descartes Datamyne data affirms this conclusion. For example, we compared gains and losses in U.S. imports in pandemic year 2020 between relatively diverse value chains (where the top country of origin accounted for a quarter or less of total import value), and those that depend more on fewer sources (imports for which the top COO claimed a share greater than 25%). Here are the results of the comparison at the level of the Harmonized System’s Sections:

The IMF analysis finds broad economic benefits of diversification. For example, given a 25% labor supply contraction in a single global supplier, the GDP of the average country falls 0.8%. In the IMF high-diversification scenario, the drop is cut nearly in half, as illustrated in this chart:

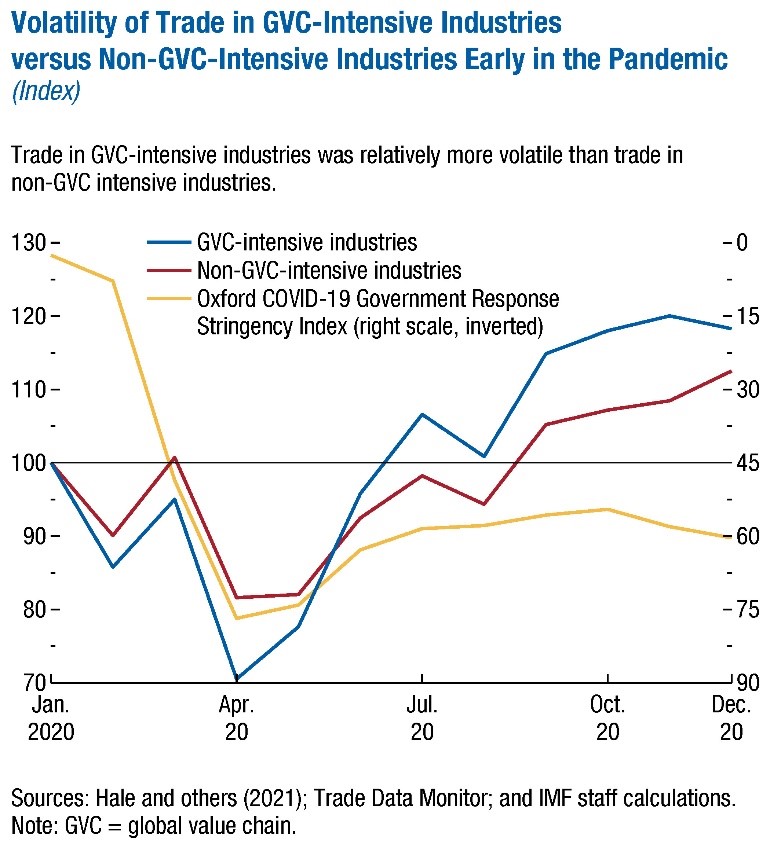

The IMF also compared trade volatility in industries that are “global value chain-intensive (GVC)” – that is, the automotive, electronics, textiles and apparel, and medical goods industries – versus those that are more dependent on near-shore or domestic suppliers during pandemic year 2020. They found that the stringency of government lockdowns correlated with the downturn in imports. The GVC-intensive industries experienced a sharper, deeper downturn as lockdown took effect, but rebounded faster and further as government restrictions eased, as this chart illustrates:

Reshoring is not the solution to supply chain disruptions: IMF

Acknowledging that cross-border supply chain disruptions have prompted calls to bring production “back home,” the IMF research argues that dismantling GVCs is not the solution to shortages and idled assembly lines.

To the contrary, GVC-intensive industries proved more adaptable to the extraordinary disruptions of 2020. The IMF analysis reveals shifts in market shares early in the pandemic among regions with significant participation in GVCs. Imports fell by much less as a result of 2021 lockdowns as experience was gained in maneuvering around the supply chain disruptions.

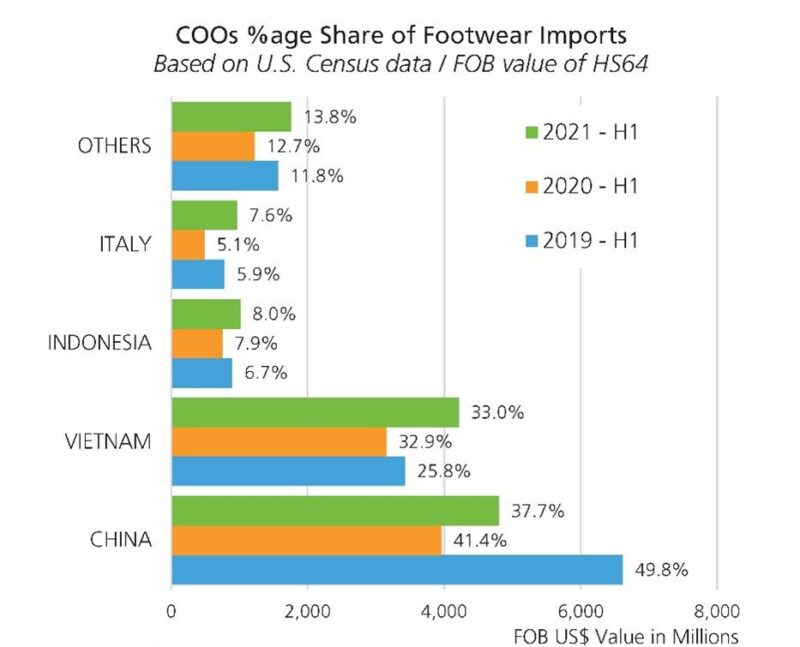

Descartes Datamyne global trade data affirms shifts in market share in U.S. import trade. For example, in the relatively GVC-intensive footwear sector [HS64], we found share shifting from China to other sources. Whether the pie was shrinking in 2020, or expanding in 2021, bigger slices went to Vietnam, Indonesia, and others, as this chart summarizes:

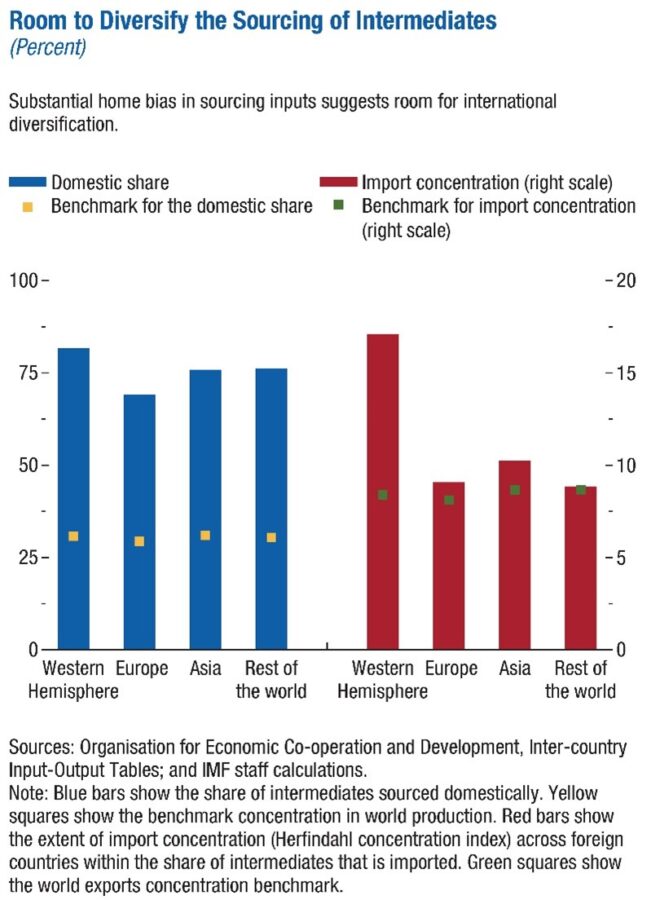

The IMF sees plenty of room for more diversification away from domestic suppliers to many more international sources. In fact, there is a significant “home bias” toward domestic sourcing of intermediate inputs.

For instance, Western Hemisphere companies get 81.76% of intermediate inputs from domestic sources (the blue bar in the chart below), far above a benchmark of 30.81% for domestic share. The largest producer accounts for 17.11% of the Western Hemisphere’s imported inputs (the red bar), slightly more than double the 8.4% benchmark for production concentration. [The Outlook’s Online Annex 4.2 contains details on how these percentages were arrived at.] This chart summarizes the IMF calculations on domestic share and import concentration of inputs by region:

Practical steps for companies to diversify supply chains

Of course, it’s not regions, nor (most) countries that execute (though they may encourage, support and/or incentivize) diversification strategies for their industries’ GVCs. That’s down to the industries’ individual business enterprises, from multinational corporations to family-owned companies. That’s where Descartes Datamyne global trade intelligence comes in.

Businesses use our global trade intelligence to gain a macroview of their industries’ GVCs, evaluate their supply chains against prevailing practice, score their chains’ diversification versus concentration of sources, and identify alternative sources and routes to build resilience. With access to the underlying transaction records, value chain strategists can drill down to locate shippers, their customers and sources, and logistical details.

In a recent SupplyChainBrain Webinar, Descartes Datamyne experts walk through the practical steps, powered by global intelligence, supply chain strategies can take to:

- Optimize Trade Lanes: Streamline the supply chain by shifting to less congested shipping lanes.

- Diversify Suppliers: Identify and vet alternative sources of supply to multiple options when disruptions arise.

- Calculate Landed Costs: Assess and compare the costs of doing business with buyers and sellers around the world.

- Screen for Denied Parties: Screen trading partners to make sure they are not on any government watch list.

To watch a recording of the SupplyChainBrain Webinar, Strategies to Mitigate Congestion on Your Supply Chain, click here [registration required], or you can read the article.

How Descartes Can Help to Strengthen Your Supply Chain Resilience

Descartes Datamyne delivers global trade intelligence with comprehensive, accurate, up-to-date, import and export information that helps companies save significant time in spotting supply and demand shifts, optimizing trade lanes, expanding into new markets and identifying new buyers and suppliers.

Datamyne features the world’s largest searchable trade database covering 230 markets across five continents. Gathered directly from official filings with customs agencies and trade ministries, including bills of lading, our data is detailed (down to company names and contact details), timely and authoritative.

Descartes software solutions include a landed cost tool to calculate the economic viability of importing from a range of markets. Our applications can also screen against multiple denied parties lists simultaneously to help ensure organizations are not doing business with entities named on official government watch lists.