Descartes Datamyne™ trade data reveals shifting trade patterns as toy companies diversify sources to dodge steep import duties. But buy- and sell-side market dynamics are also in play.

Key Takeaways

- U.S. tariffs and policy uncertainty reshaped global trade in 2025, disrupting long-standing trends and forcing both buyers and sellers to rapidly adapt.

- Toy imports declined sharply, with volumes through November down 13% year-over-year as importers delayed orders and navigated volatile tariff conditions.

- Retailers shifted ordering strategies, relying more on domestic distribution by toymakers, allowing later, smaller, and more flexible purchasing decisions.

- Decoupling from China accelerated, with notable gains for Vietnam and Mexico in toy and electronics sourcing as companies diversify to reduce tariff exposure.

- Smaller toy companies face the greatest strain, with rising duties, reduced margins, and order cancellations threatening viability in a highly competitive market.

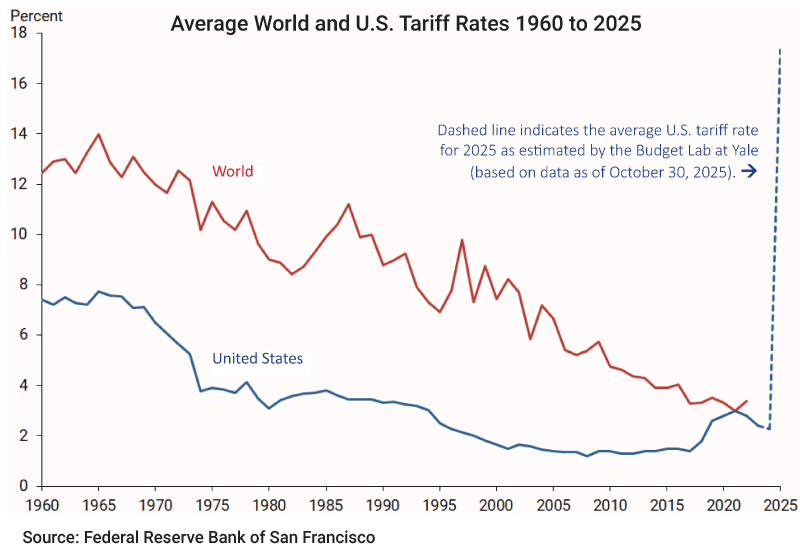

There is no arguing that the global trade system sustained an unprecedented shock in 2025. As this chart from the Federal Reserve Bank of San Francisco (FRBSF) shows, current U.S. trade policies sharply reversed a 60-year worldwide trend toward tariff-free trade:

Figure 1 Average Tariff Rates – U.S. and World 1960 -2025

However, as the FRBSF cautions in its November 24 Economic Letter, measuring direct effects of the U.S. tariffs is challenging because markets are dynamic, with buyers and sellers adapting to changing terms of trade.

For instance, a company might diversify suppliers, redirect planned investments, or trim profit margins instead of passing new overhead on to customers. Consumers might opt to do without a pricier product, choose a lower-cost substitute, or pay the price while cutting back on other purchases. Whether buying or selling, figuring out what to do next is especially fraught given the extreme uncertainty created by rapidly evolving government trade policies.

With the FRBSF caveat in mind, we looked at this year’s data on the trade goods that traditionally helped lift waterborne import volumes to an autumn peak and, until now, have been exempt from U.S. tariffs: toys.

A Midsummer Peak for Waterborne U.S. Imports in 2025

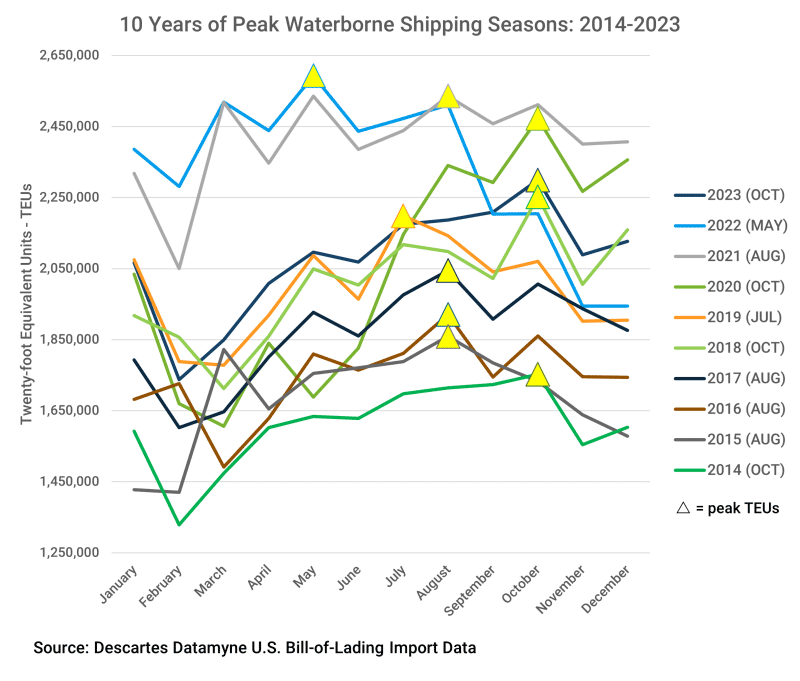

The peak shipping driven by merchants stocking up ahead of the year-end holidays has become something of a moveable feast in recent years, as the trade data indicates:

Figure 2 Monthly Volume of U.S. Waterborne U.S. Imports 2014 -2023

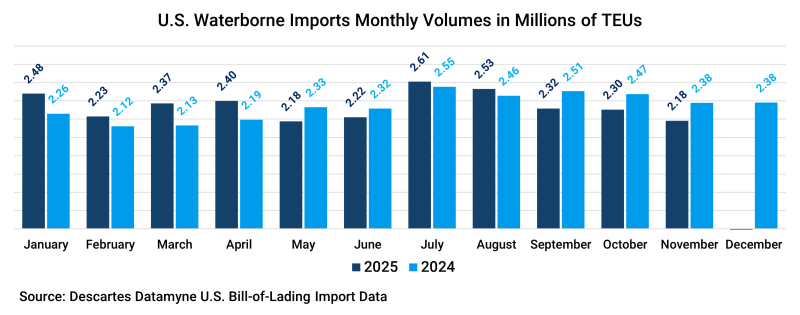

Descartes Datamyne trade data for 2024 and 2025 (through November) reveals yet another break with tradition, with maritime import shipments in both years reaching peak volume in July, as the next chart shows. Our data also captures the rush to ship capital goods and inputs as well as merchandise in the early months of 2025 in anticipation of higher U.S. tariffs.

Figure 3 Monthly Volume of U.S. Maritime U.S. Imports 2024 – 2025

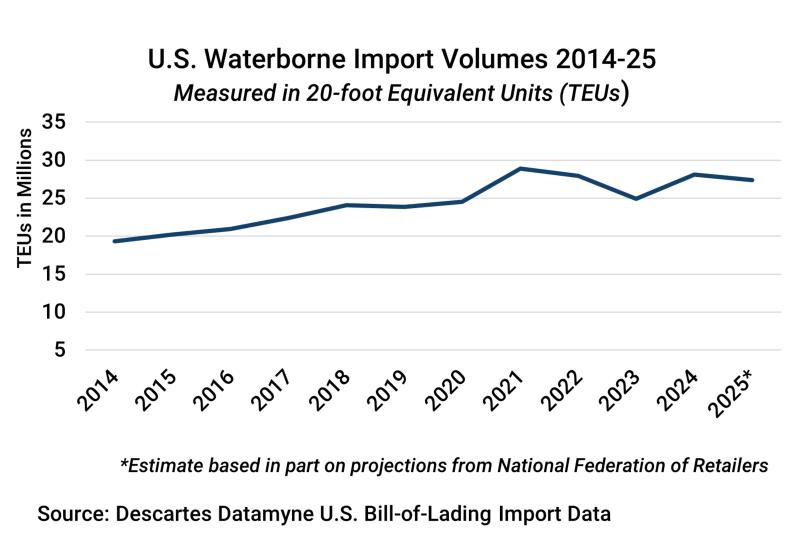

The post-peak decline in monthly twenty-foot equivalent units (TEU) volumes began in August this year. Subsequent months through the end of November have seen inbound shipments lagging behind 2024 levels, with slim chance of catching up in December, as the next chart illustrates:

Figure 4 Annual Volume of U.S. Maritime U.S. Imports 2014 – 2025

The Financial Times suggests that companies are now making a tactical shift from front-loading ahead of U.S. tariffs to back-running – that is putting off purchases – in anticipation of more favorable tariff rates yet to be negotiated by the U.S. with its trade partners.

Fewer Toys Under the Tree: Are Tariffs to Blame?

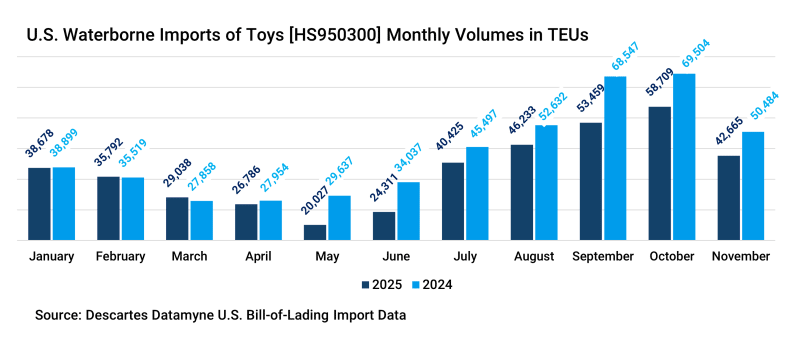

Toys are among the peak season’s bellwether products. Based on Descartes Datamyne maritime trade data, toy importers did not, as a group, embrace front-loading at the start of 2025. Indeed, monthly volumes have generally been below the previous year’s, with the tally for the 11 months ending in November -13% lower than the same period in 2024. Peak October was -15% off the same month a year ago.

Figure 5 Monthly Volume of U.S. Waterborne U.S. Imports of Toys

U.S. tariffs, especially the uncertainty around a volatile tariff regime, caused importers to proceed with caution in placing orders.

Most toys sold in the U.S. are imported: the Toy Association has estimated that three-quarters are made in China. Toys have been exempt from tariffs since the first Trump Administration. But in 2025 U.S. tariffs on Chinese imports as high as 145% (the current rate is 30%) amounted to what one toy company exec called a “de facto embargo.” Moreover, the administration’s Liberation Day tariffs announced April 4 extended U.S. tariffs to countries, such as Vietnam and India, that top toy companies’ lists of alternative sources.

A deeper dive into the trade data reveals some of the market dynamics in play.

Retailers’ Shift Pre-Holiday Ordering Patterns

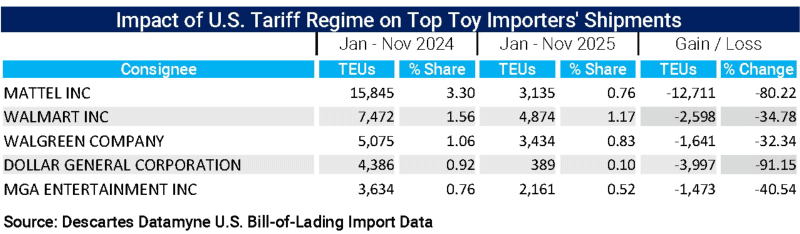

Figure 6 Top Consignees for U.S. Maritime U.S. Imports of Toys

Our bill-of-lading (BOL) data shows that Mattel did front-end load inventories in 2025, with the bulk of its shipments arriving in the U.S. by March. The company explained (in its third-quarter earnings call) that its strategic challenge this year has not been tariff costs (yet to fully flow through to inventories), but a big change in the way its customers – toy retailers – order products.

Generally, retailers can improve margins by using their own logistics networks to import directly from the country of origin (COO). These shipments are usually for large quantities, ordered months in advance. This year, retailers opted to go with domestic shipping – that is, letting toymakers handle importation and warehousing, thus enabling retailers to order smaller quantities, more frequently, and later in the year as they get a better read on consumer demand.

In essence, relying on domestic shipping to stock shelves shifts some risk of inventory overhangs from retailer to manufacturer. In a positive note, toymakers were reporting a bounceback in orders from retailers in the fourth quarter.

Decoupling from China

Reducing reliance on China as a primary source for manufactured goods has been top of agenda for U.S. trade policy since 2018, the opening round of U.S. tariffs on a broad range of Chinese goods (as opposed to targeted rates arising from antidumping / countervailing duty investigations).

Descartes Datamyne U.S. Census data for 2018 shows China leading all other countries of origin with a 21% share of this trade by value. By 2024, China accounted for a 13% share, eclipsed by top COO Mexico’s 16%. As of this August (the latest available government data at this writing), China ranked third among COOs, with a 9% share, behind Mexico and Canada, sources for 15% and 11% of U.S. imports, respectively.

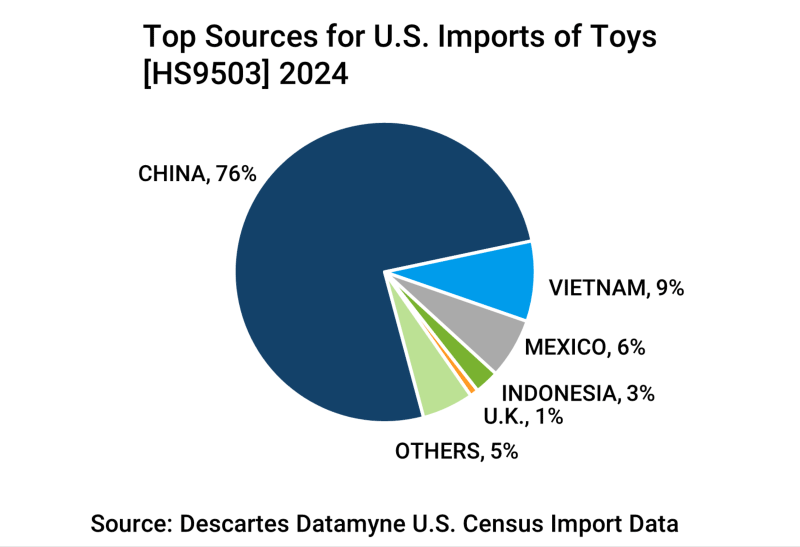

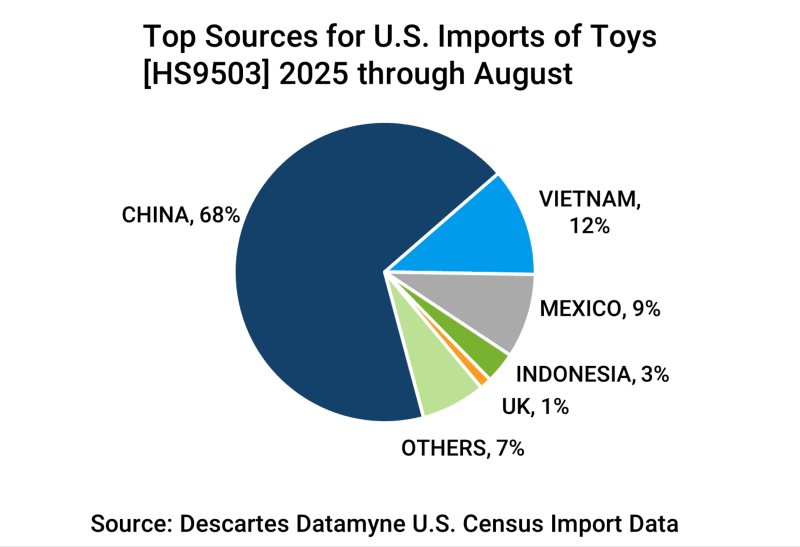

Since 2018, China’s share of U.S. toy imports by value has eroded from 85% in 2018 to 76% in 2024. Decoupling appears to have picked up momentum this year (through August), with China’s share of this trade falling from 76% to 68%, while Vietnam and Mexico gained.

Figure 7 Countries of Origin for U.S. Imports of Toys 2024

Figure 8 Countries of Origin for U.S. Imports of Toys 2025

Our BOL data also shows a steady decline in China’s share of U.S. waterborne volumes overall – from 45% in 2018 to 38% last year.

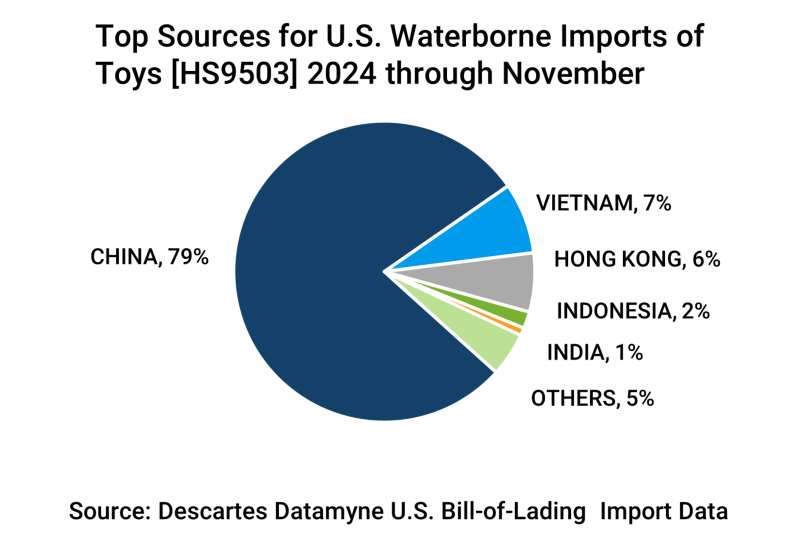

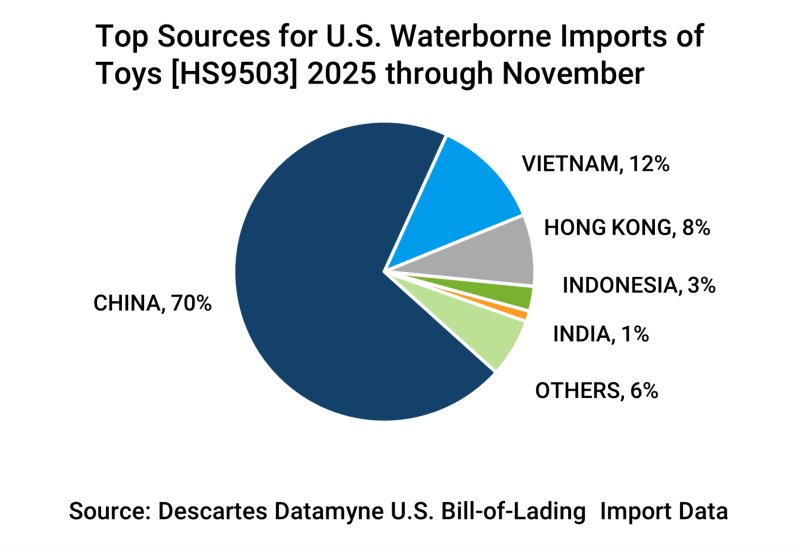

In contrast, China’s share of maritime U.S. imports of toys have held steadily at 78-79% since 2018. This year (through November) China’s share fell nine percentage points to 70% compared with over the same 11-month period in 2024. Keep in mind that, while a tariff on toys was proposed in 2018, it was ultimately shelved (as proposed U.S. tariffs on such consumer goods such as apparel, smartphones, video games, and furniture). There was less financial impetus to diversify sources. There is no carve-out for toys in the current tariff regime.

Figure 9 Countries of Origin for U.S. Maritime Imports of Toys 2024

Figure 10 Countries of Origin for U.S. Maritime Imports of Toys 2025

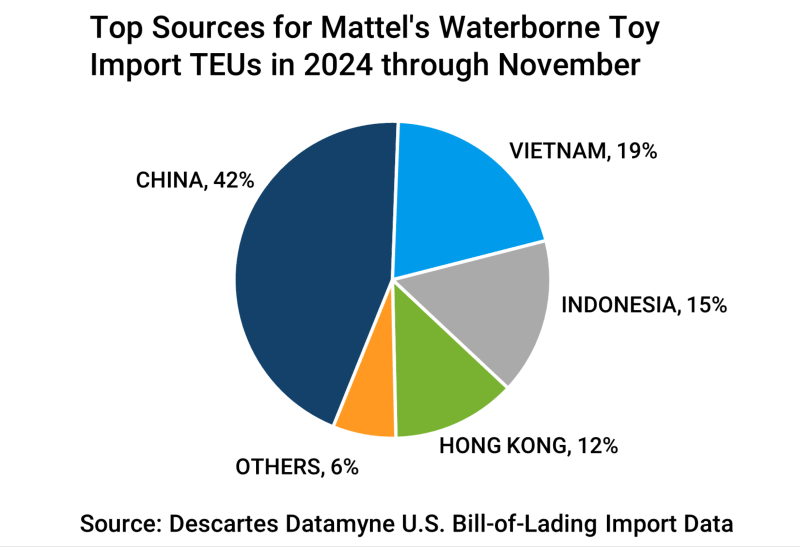

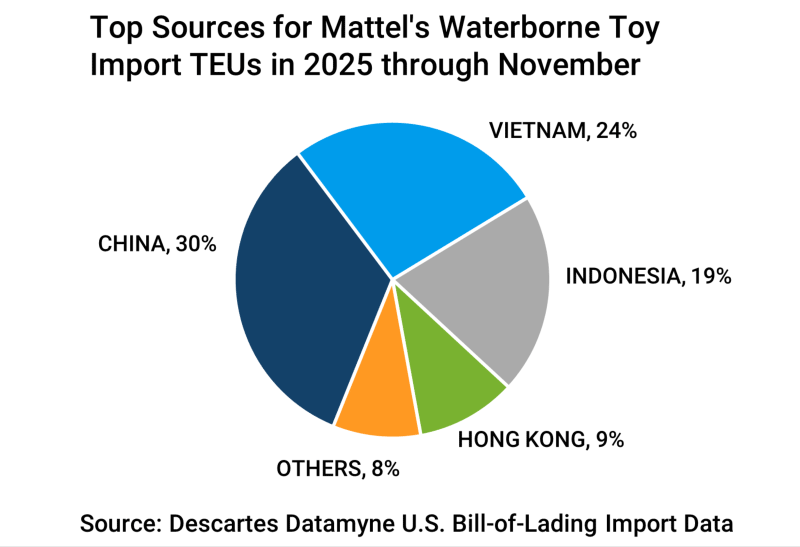

The leading importer among toymakers, Mattel responded to the new U.S. tariffs by announcing it would accelerate its efforts, already underway, to diversify overseas production. Our BOL data shows China’s share of shipments to Mattel in the U.S. at relatively low 42% in 2024 falling to 30% in 2025, as the next charts show:

Figure 11 Countries of Origin for Mattel’s Toy Imports 2024

Figure 12 Countries of Origin for Mattel’s Toy Imports 2025

As reported by toydirectory.com, leading U.S. toymakers have set ambitious goals in reducing their reliance on China. Mattel aims to lower China’s share of global production to 25%, and its U.S. sales to less than 10% by 2027.

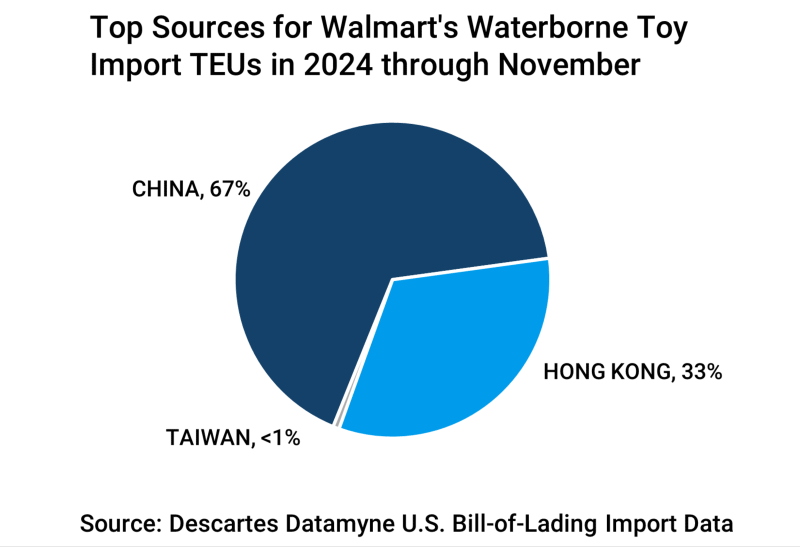

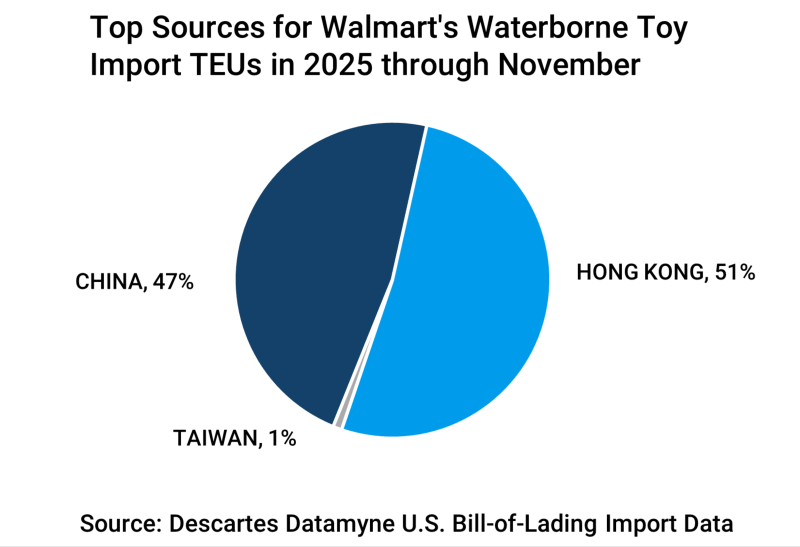

In contrast, Walmart does not plan to decouple from China. This year’s top consignee of waterborne toy imports did suspend orders from China for some weeks when the most draconian tariffs were announced. The BOL data does shows an increase in shipments from Hong Kong. But tariff mitigation is likely not the main consideration: Since 2020, the U.S. has applied the same tariff treatment to cargos from China and Hong Kong.

Figure 13 Countries of Origin for Walmart’s Toy Imports 2024

Figure 14 Countries of Origin for Walmart’s Toy Imports 2025

Toy Industry Faces More Headwinds

As we’ve reported before, the toy industry has long been facing an existential challenge as children abandon traditional toys and games for hi-tech playthings, such as video games, consumer electronics, and social and digital media, at increasingly younger ages.

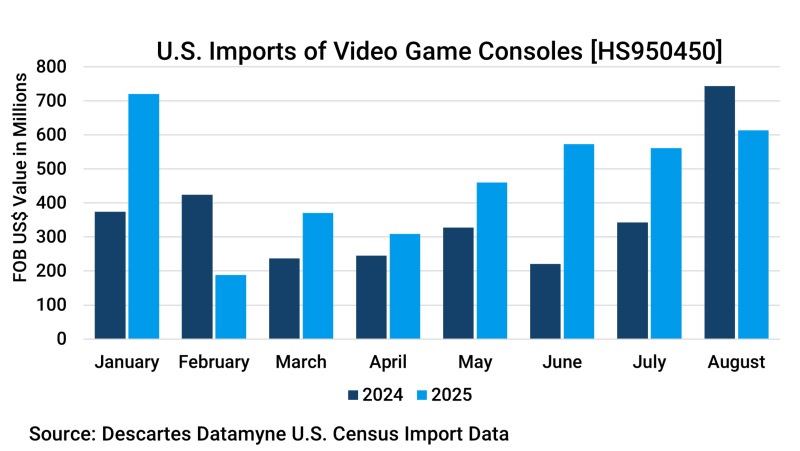

Now the second-ranked product by trade value among the toys, games, and sports gear denoted by HS95, video game consoles accounted for 17% of the category’s imports, while toys accounted for 38%. Running counter to toy imports, game consoles surged this February and again in August, our U.S. Census data shows:

Figure 15 U.S. Imports of Video Game Consoles Monthly through August 2024 vs 2025

=

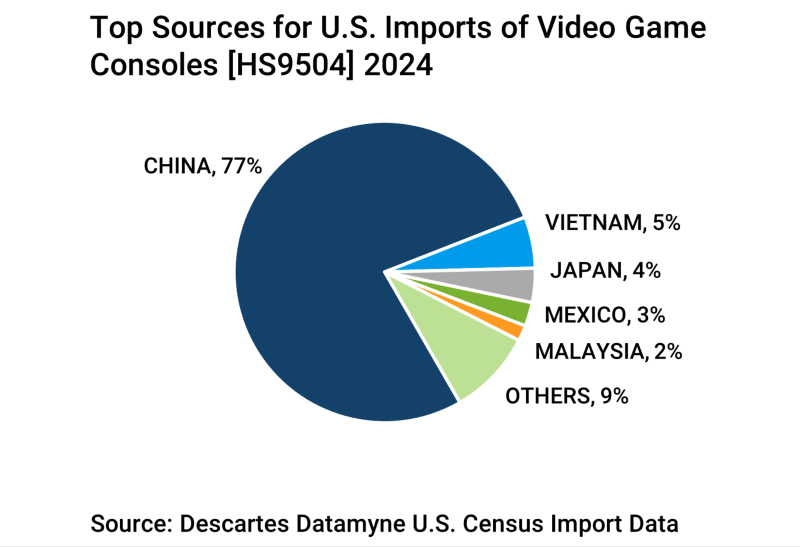

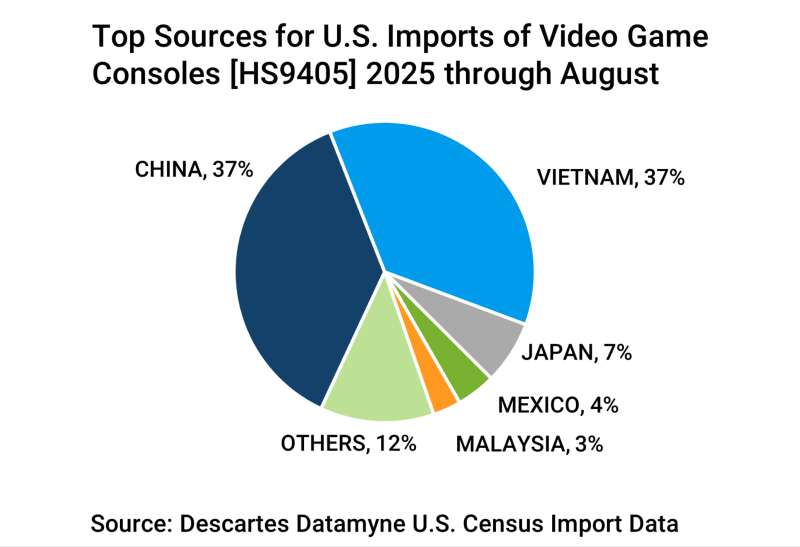

More interesting is the substantial shift in sourcing game consoles away from China, which commanded a 77% share of this trade in 2024, to Vietnam, with a 36.6% share just a fraction below China’s 37.1%.

Figure 16 Countries of Origin U.S. Imports of Video Game Consoles 2024

Figure 17 Countries of Origin U.S. Import of Video Game Consoles 2025

Game consoles claimed a 25% share of imports in 2023. The Financial Times suggests the decline in console sales is potentially due to consumers postponing upgrades of smartphones and cars. In any event, games software cartridge sales and online subscriptions are experiencing robust growth. That’s good news for the gaming industry, but more competition for consumer dollars that might once have gone to toys. According to this report from NPR, this year’s mania for collectible trading cards is also siphoning sales from toys.

The same NPR report suggests that holiday shoppers will find some higher prices and some shortages at stores and online. There will be toys under the tree, but they may be fewer and second- or third-choices.

Finally, high-volume importers are better positioned to maneuver in the volatile tariff environment. With the average tariff rate on toys reaching 22.3% as of August (as calculated by We Pay Tariffs), smaller and mid-sized companies are limited in how much of this added cost they can absorb or pass along to their customers.

According to the Toy Association, 96% of U.S. toy companies are small- or mid-size enterprises, and roughly half of those surveyed this Spring reported the proposed tariff rates could force them to go out of business in a matter of weeks. Sixty-four percent of small companies and 80% of mid-sized firms said they had cancelled orders for toys. The trade association is a lead advocate for keeping toys tariff-free.

Surveying the retail industry heading into the holidays, the National Retail Federation concluded in November that postponements in imposing new U.S. tariffs combined with retailers mitigating strategies will have blunted the effects of the new tariff regime on the availability and pricing of products for shoppers. But the on-again, off-again U.S. tariffs that have stymied long-range planning will likely continue to slow new merchandise orders – and add to costs – through yearend and on into 2026.

How Descartes Can Help Companies Navigate Tariffs and Supply Chain Shifts

The 2025 tariff environment has introduced extraordinary uncertainty for manufacturers, retailers, and importers. As companies reassess sourcing strategies, adjust seasonal ordering patterns, and respond to evolving consumer behavior, timely and granular trade intelligence has become essential. Descartes Datamyne provides the data-driven visibility needed to make confident decisions amid volatile trade policies and shifting global production.

With Descartes Datamyne, organizations can:

- Monitor real-time shifts in import volumes at the monthly and even shipment level, enabling companies to gauge retailer demand, competitor activity, and seasonality patterns disrupted by tariffs.

- Track diversification away from China using U.S. Bill-of-Lading and U.S. Census data to identify emerging sourcing hubs such as Vietnam, Mexico, and India—and evaluate the impact of new tariff exposure on each.

- Analyze importer behavior, including front-loading, back-running, or shifting to domestic distribution models, helping companies benchmark their strategies against industry leaders.

- Identify new suppliers or production partners as companies accelerate decoupling efforts or seek tariff-free or lower-tariff alternatives.

- Forecast potential inventory or pricing challenges using historical and in-year BOL trends—critical for retailers preparing for holiday seasons where demand signals are harder to read.

As tariff regimes continue to evolve and sourcing strategies undergo rapid reconfiguration, Descartes equips businesses of all sizes with the insights they need to stay resilient and competitive. From understanding where the market is headed to quantifying the impact of policy changes, trade data from Descartes Datamyne empowers companies to adapt quickly, protect margins, and better serve consumers in an uncertain global trade environment.

Request a Demo

See how Descartes Datamyne can help you navigate tariff volatility, identify new sourcing opportunities, and stay ahead of shifting toy industry trade patterns.

Start a Free Trial

Experience the power of Descartes Datamyne trade intelligence firsthand. Explore shipment-level data, sourcing trends, and market insights with full platform access.